Posted by Bryn Battersby and Ian Lienert[1]

Institutional arrangements of Ministries of Finance (MoFs) can impact the effectiveness of achieving macro-fiscal objectives and longer-term fiscal stability. Our new IMF Working Paper is a cross-country study of macro-fiscal functions in selected African countries and fills an important knowledge gap. The paper draws on the results of a survey of the macro-fiscal function of 16 east and southern Africa countries. It also includes an analysis of the macro-fiscal forecasts of most of the countries in our sample.

Although most of the 16 MoFs have established a macro-fiscal department (MFD) or unit, their functions, size, structure, and outputs vary considerably. We present data on staff size, functional scope and the forecasting performance of MFDs and identify common challenges in the countries reviewed.

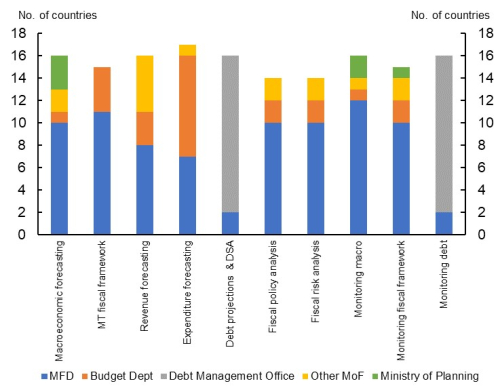

We find considerable diversity in the functions performed, the structure, size, status (within the MoF), and legal frameworks for the MFDs of the region. For example, in the chart below, we identify the extent to which 10 macro-fiscal sub-functions are shared with other MoF departments and, in some countries, with the Ministry of Planning.

Figure 1. Distribution of Macro-Fiscal Functions

Source: Surveys of the 16 countries.

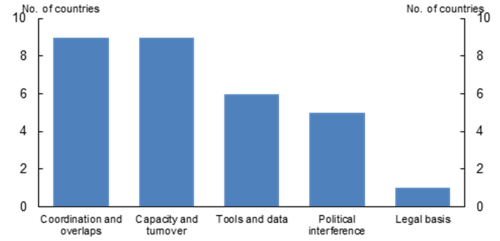

We ranked the perceived difficulties of macro-fiscal management according to how commonly the challenges were reported across the 16 countries (Figure 2). Lack of internal coordination, overlapping responsibilities, limited capacity for macro-fiscal analysis, and high staff turnover are widespread challenges. We see merit in establishing the MFD as a single department of the MoF with a broad mandate to cover most macro-fiscal functions because this type of arrangement helps with internal coordination. MFDs should be recognized as a vital department of the MoF, with broadly comparable status to the Budget, Treasury, Debt Management, and Accountant General Departments.

Figure 2: Challenges in Performing Macro-Fiscal Functions in East and Southern African MFDs

Source: Surveys of the 16 countries.

Our data indicate that most MFDs of MoFs face significant challenges to recruit and retain skilled staff. Macro-fiscal forecasting tools should be designed to be sustainable in the context of higher turnover, using techniques and software that are readily useable by new analysts. The number of MFD staff and the MFD’s internal salary structure (relative to other MoF departments) should be adapted to the breadth of the MFD’s functions and its mandated outputs.

Our paper includes a review of macroeconomic and fiscal forecasting performance. We find that performance is variable but tends to be better in smaller MFDs with lower staff turnover and greater transparency in publishing their macro-fiscal outputs. These conclusions were reached from a panel regression of the average forecast errors and average absolute forecast errors for revenue against relevant survey results. Unsurprisingly, the regressions also showed that high staff turnover is a strong predictor of more biased and less accurate forecasts.

To draw attention to the importance of the work of MFDs, finance ministries should commit to periodic postmortems of their macroeconomic and fiscal forecasts. Such reviews could be carried out in-house or, alternatively, by external consultants. Exposure of macro-fiscal forecasts to an external review would mitigate the pressure to bias the forecasts for political reasons and help build the credibility and reputation of the MFD.

Finally, to highlight the importance of MFDs and enhance the comprehensiveness of macro-fiscal outputs, the PFM laws of some countries might need to be amended, to include provisions on medium-term fiscal frameworks, fiscal risks and other core MFD outputs.

[1] Bryn Battersby is a Senior Economist in the IMF’s Fiscal Affairs Department. Ian Lienert is a former staff member of the IMF’s Fiscal Affairs Department. He is now a consultant in public financial management, based in Toulouse, France.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.