Posted by Rehemah Namutebi, Imran Aziz, Kubai Khasiani, and Gerhard Steger[1]

Background

Performance Based Budgeting (PBB) encompasses a broad variety of approaches with the objective of incorporating policy results and impacts in the budget negotiations and documents. Although there is no single definition of PBB its essence focuses on two key questions: How much money will be available in the upcoming budget period for entities funded by the budget? What policy results are supposed to be achieved by using this money?

Since 2018 Rwanda has developed a lean home-grown PBB approach to implement its National Strategy for Transformation 2017-2024 (NST1). This approach builds upon the preexisting cultural tradition called “Imihigo” where individuals set targets to be achieved within a specific period. Within government this process is reflected by institutional performance contracts for each budget agency, and individual performance contracts for civil servants at every level of government.

Rwanda’s PBB reforms over the past two years have been based on four core principles that have elevated Imihigo to the national strategic level:

- Plan and budget linkages: to connect the sector and program budget structure to NST1 priority areas, with a lead budget agency made accountable for results.

- Simplicity: to minimize the proliferation of complex information so that accountability and results can be easily tracked.

- Consultation: the reform was gradually introduced through targeted piloting so that all relevant stakeholders could provide input into the design and have full ownership.

- Full budget cycle approach: to ensure that planning, budgeting, and reporting processes are fully connected to inform decision making, anchored in the government’s Integrated Financial Management System (IFMIS).

Main design features

The Ministry of Finance and Economic Planning (MINECOFIN) guides the PBB process and has developed six standardized steps to be applied to all sectors.

Step 1 aligns the sector to one of the 18 priority areas and 7 cross-cutting areas of the NST1.

Step 2 conducts a quantified diagnosis of the most important challenges for (and causes of) the implementation of the identified strategic priority areas.

Step 3 designates a lead budget agency and relevant budget programs responsible to address these challenges.

Step 4 assigns an objective to each budget program.

Step 5 involves developing up to three performance indicators per budget program and one annual target per indicator for each of the upcoming three financial years.

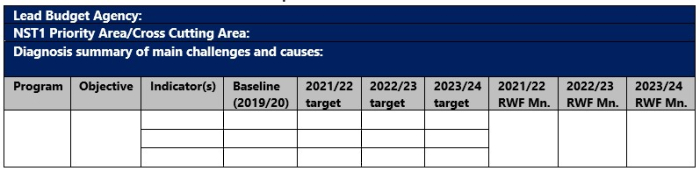

Step 6 involves populating a standardized template with the information from the previous five steps (see table below).

Table. Standardized Rwandan PBB template

Note: Similar templates have also been designed for in-year and end-year reporting, not illustrated here.

Achievements and challenges

The reforms have been championed by the Budget Department of MINECOFIN which led on the design needs and facilitated discussions across government. The IMF’s East Africa Regional Technical Assistance Center (AFE) assisted in the design of the approach, initial piloting for four sectors, and supporting the development of a technical manual. The World Bank has since provided follow-up support to rollout to all 16 Rwandan sectors and their budget agencies.

The rollout has revealed a number of challenges which need to be addressed as the PBB becomes embedded in the years ahead. Examples include: (1) limited reliable data to define the challenges and their causes to implement strategic priorities; (2) the formulation of proper result chains that comply with S.M.A.R.T. (for objectives) and C.R.E.A.M. (for indicators and targets) criteria;[2] and (3) Rwanda is a frontrunner of Gender Responsive Budgeting (GRB) in Africa and would benefit from a consistent PBB and GRB approach.

Next steps

- The government is aiming to publish the completed PPBs for all 16 sectors as an annex to the Finance Law for 2021/22.

- A monitoring, evaluation and reporting framework has been developed, and will be operationalized through the IFMIS in the first quarter of the next financial year.

- The extension of the PBB approach from central government to local governments is in preparation and is essential as several key public services are decentralized in Rwanda.

- Several East African countries have expressed interest in the Rwandan home grown approach. There are plans to extend existing peer learning networks into Western and Southern Africa so that more countries can benefit from the lessons of the Rwandan model.[3]

[1] Rehemah Namutebi is Head of the National Budget Department in the Ministry of Finance and Economic Planning in Rwanda; Imran Aziz and Kubai Khasiani are PFM Advisors in the IMF’s Regional Technical Assistance Centers for, respectively, East Africa and West Africa 2; Gerhard Steger is a former Austrian Budget Director.

[2] SMART: Specific, Measurable, Achievable, Relevant, Time-bound. CREAM: Clear, Relevant, Economic, Adequate, Monitorable.

[3] AFE recently conducted a webinar between five member countries who have attempted PBB reforms in the past ten years (Malawi, Kenya, Rwanda, Tanzania and Uganda). The Rwanda approach received great interest and a peer learning network has been developed to share experiences to integrate PBB as part of their budgeting, execution, and reporting IT systems.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.