Posted by Bryn Battersby and Camilo Gomez Osorio[1]

The saying “when it rain, it pours” could not be more representative of the challenges of fiscal risk management in 2020. COVID-19 has caused a deep macro-fiscal shock for many countries and has triggered unforeseen exposures to public finances. The pandemic has been particularly challenging for many low-income developing countries, which already had limited fiscal space to respond forcefully to large shocks before the crisis began. COVID-19 continues to create considerable uncertainty around the economic and fiscal outlook and raises the possibility of new and serious contingent liability realizations.

Governments have looked to their macro-fiscal and fiscal risk units to reduce this uncertainty and to assess the economic and fiscal impact of COVID-19. But estimating the impact of COVID-19 and the containment measures on an economy is difficult, in part because the scale of the crisis is unmatched in recent history, and because the pandemic has created both a supply and a demand shock.

To introduce countries to new IMF tools for assessing fiscal sustainability and macro-fiscal risks, the Fund’s Fiscal Affairs Department worked with other partners[2] to prepare a two-module course on Fiscal Risks During COVID-19. The course brought together participants from treasury, macro-fiscal, fiscal risks, and debt units of finance ministries in 21 African countries, as well as representatives from central banks. The multi-lingual remote setting provided a forum for sharing country experiences and international best practices in identifying and managing fiscal risks during the pandemic.

The course prioritized the quantification of macro-fiscal risks using practical methodologies that estimate exposures. These tools include the IMF/World Bank Debt Sustainability Framework for Low-Income Countries (LIC DSF) and the new COVID-19 module of the IMF’s Fiscal Stress Test. The tools provide parameters that can be used to prepare revenue and expenditure forecasts, and medium-term fiscal frameworks that reflect the range of uncertainty during COVID-19.

The first module of the course on Fiscal Risks and Debt Sustainability Analysis in Low-Income Countries trained participants on assessing the impact of shocks on fiscal sustainability. During these turbulent times, ministries of finance are rising to the challenge of pursuing counter-cyclical fiscal policy to smooth the downturn in the short term so as to preserve fiscal sustainability over the medium term. The module explored how to assess the impact of materializing contingent liabilities (such as government guarantees and the budgetary cost of pending court cases) and other fiscal risks using the LIC DSF framework. Participants also learnt how this framework can be a powerful tool for macroeconomic management and budgeting.

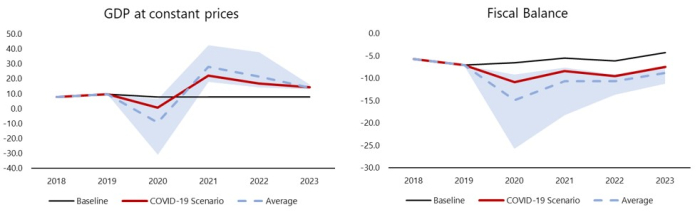

The second module on Preparing the Macro-Fiscal Scenarios During COVID-19 guided participants in using the new COVID-19 Fiscal Stress Test module. This Excel-based tool allows users to enter their country’s macro-fiscal data and then review the macro-fiscal impact of the COVID-19 shock according to the duration and strictness of a lockdown. The module provides charts and tables showing the range of likely outcomes, which can be easily incorporated in the analytical and budget outputs of macro-fiscal and fiscal risk units. Figure A demonstrates the types of V-shaped macro-fiscal shocks that were modelled during the course. The module has already been used by several countries in the region to analyze fiscal risks and prepare fiscal risk statements.

Figure A: Examples of the range outcomes for macro-fiscal variables using the COVID-19 module of the Fiscal Stress Test

Perhaps most importantly, the course helped to break two common misconceptions. The first misconception was that the quantification of these types of fiscal risks requires sophisticated tools and precision. In practice, however, what matters most is the approximate scale of the shock, which can usually be estimated quickly and easily, particularly with the COVID-19 module of the Fiscal Stress Test. The second misconception was that the LIC DSF framework is a tool useful only for debt portfolio management. In fact, the DSF is a powerful macro-fiscal forecasting tool that can provide scenarios and debt paths that are crucial for building medium-term fiscal frameworks and advising on appropriate fiscal policy – the bread and butter of a typical macro-fiscal department.

This Fiscal Risks Analysis course will be delivered again in September 2021 with participants invited from countries across Africa. Stay tuned!

This article is part of a series related to the Coronavirus Crisis. All of our articles covering the topic can be found on our PFM Blog Coronavirus Articles page.

[1] Bryn Battersby is a Senior Economist in the IMF’s Fiscal Affairs Department; Camilo Gomez Osorio is a PFM Advisor in the IMF’s Regional Technical Assistance Center for Southern Africa (AFRITAC South).

[2] AFRITAC South, the Africa Training Institute, AFRITAC East, and the Macroeconomic and Financial Management Institute of Eastern and Southern Africa (MEFMI).

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.