Posted by Eivind Tandberg, Rui Monteiro, Isabel Rial[1]

Public infrastructure projects are typically large and complex, with long planning, implementation, and operational periods. They are inherently exposed to many different uncertainties and risks. However, project risks are often not well integrated in infrastructure governance frameworks and receive only moderate attention during major investment decisions. Governments’ decision-making is typically short-sighted, and the long-term costs and benefits are poorly reflected in most standard budget systems. Planning and monitoring systems may help decision-makers understand the long-term effects of infrastructure projects, but these systems are often limited in their scope and coverage. As a result, risk management of infrastructure projects remains underdeveloped and infrastructure project outcomes often deviate significantly from expectations or forecasts.

A chapter[2] in the recently published IMF volume, Well Spent: How Strong Infrastructure Governance Can End Waste in Public Investment, discusses fiscal risks related to public infrastructure. It advocates that better risk management practices can improve outcomes in public infrastructure projects. The chapter finds that all countries, regardless of income or development level, can strengthen their infrastructure governance framework by gradually incorporating a risk management function.

The Nature and Sources of Fiscal Risks in Infrastructure

Infrastructure projects have distinct characteristics that make them particularly risk prone (Figure 1). Some sources of risk are project-specific—that is, directly linked to project design, construction, and operation. Other sources of risk are market-related, such as changes in prices and interest rates. A third source of risk, so-called force majeure, transcend projects and markets and would include, for example, natural disasters, and civil disorder. Last, government actions and inactions can also be a major source of risk.

Figure 1. Characteristics of Infrastructure Projects

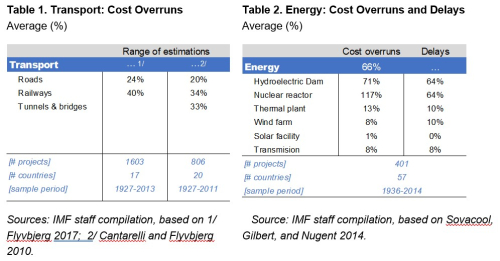

Risks in infrastructure can materialize as large fiscal costs with significant macroeconomic implications. Tables 1 and 2 summarize cross-country data for large projects in the transport and energy sectors. They show that for a large sample of projects implemented over the last century, governments have on average paid approximately 33 percent more than originally budgeted for roads, railways, tunnels, and bridges (Table 1). Similarly, cost overruns are estimated at 66 percent on average for the energy sector, while project delays can be up to 64 percent in complex projects such as hydroelectric dams and nuclear reactors (Table 2).

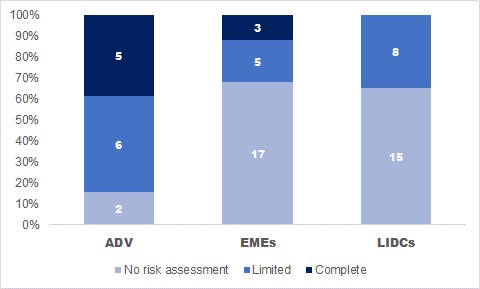

Public Investment Management Assessments (PIMAs) conducted so far show that a reactive approach to infrastructure fiscal risks remains the norm, with action taken only after things go wrong. Risk assessments are not systematically included in project appraisal procedures, particularly in low-income developing countries and emerging market economies (Figure 2).

Figure 2. Risk Assessment in Project Appraisals, PIMA Database

Source: PIMA database, July 2019

Infrastructure risk management function

Although risks in infrastructure projects cannot be fully eliminated, governments can proactively manage them to minimize their fiscal impact. Governments can influence the probability that some risks will happen—particularly those under their control—assess their fiscal impact and prepare to cope with the residual risks. All countries, regardless of income or development level, can strengthen their infrastructure governance framework by gradually incorporating a risk management framework for infrastructure.

It is critical to identify sources of fiscal risks early in the project cycle to support better informed policy actions. The focus should be not only on projects, but also on the overall infrastructure portfolio to take advantage of project synergies and correlations. Effective data-sharing and disclosure mechanisms are also important to ensure that fiscal risk assessment becomes an integral part of project management.

Special attention should be given to infrastructure risks that originate early in the project cycle due to a government’s action or inaction. While infrastructure risks typically materialize as cost overruns and project delays once projects are being implemented, underlying risk factors are often linked to weaknesses in infrastructure governance at the planning and allocation stages. Inadequate project design, costing techniques, and risk-sharing arrangements are major sources of cost escalation, project delays, and low social dividends. Yet, these are all sources of risk that depend on decisions and actions taken by government, and therefore are under government control.

[1] Fiscal Affairs Department, IMF.

[2] Chapter 11 on “Fiscal Risks from Public Infrastructure” by Eivind Tandberg, Rui Monteiro and Isabel Rial.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.