Posted by Alok Verma and Anupam Raj[1]

The COVID-19 crisis has forced the government of India to enforce “social distancing” and a complete country-wide lockdown for at least three weeks. Government expenditure systems have been identified as one of the “essential services” to implement relief packages and make emergency payments to purchase medical supplies and equipment. Quick responses have been required to gear up procurement systems and build essential health infrastructure. Adding to the many challenges, the crisis hit at a time when India is closing its financial year, when mergers of many public sector banks are taking place, potentially impacting payment systems, and when the new Union Territory of Ladakh is being established.

To help meet these challenges, the government has implemented many changes to existing business processes and rules affecting PFM. It has leveraged the existing financial management information system (PFMS)[2] and electronic office (e-Office) application to harness digital workflows for the quick implementation of relief measures.

Important COVID-related measures so far taken by the government include:

- Relaxing the rules regarding public procurements from single source or multiple sources to secure essential medical supplies and equipment.

- Until the end of the current fiscal year, authorizing relevant ministries to use savings on their budgets to spend on COVID-19 related expenditure without the prior approval of the Ministry of Finance (MoF).

- If insufficient savings are available, authorizing ministries to charge emergency spending to a special budget line - “Relief on Account of Natural Calamities” - up to a certain limit without seeking the MoF’s approval.

- For the next fiscal year, 2020-21, inviting ministries to submit requests for additional emergency funding and authorizing them to spend beyond their existing budget appropriations without prior approval of the MoF.

- All such transactions will be submitted to the MoF later for ex post approval.

To eliminate red tape and meet the huge demands for emergency spending, the government has also decentralized the power of budget reallocations to the line ministries. To facilitate the functioning of essential services with skeletal staff, and enable working from home, the government has established a Virtual Private Network (VPN) login and streamlined security checks to access the PFMS. It has also relaxed the rules for purchases by staff of computers and laptops. To support government employees, the government successfully processed the March payroll on time.

As suppliers are not able to submit their invoices physically due to the lockdown, the government now allows them to submit invoices by e-mail which are then certified by departmental officers before payment is made.

For medical staff directly involved in treating patients affected by COVID-19, the government has put in place a comprehensive insurance scheme. The PFMS is being used to receive insurance premium payments from all medical and support staff working in hospitals. 2.2 million people including ward-boys, nurses, paramedics, technicians, doctors and specialists are covered by the scheme.

To mitigate the adverse economic impact of the epidemic, the government very quickly announced relief measures amounting to INR 170 billion (USD 2.27 billion) for the poor, much of which is being executed through the PFMS. To facilitate such large-scale transfers the government is leveraging the existing database of beneficiaries in the PFMS and other IT systems including the banks, as well as accessing beneficiary data from various welfare schemes that also operate through the PFMS. Immediate financial relief has been provided to approximately 500 million beneficiaries by payments to their bank accounts. The welfare schemes for farmers, guaranteed employment, differently abled citizens, and social assistance programs are being earmarked for further releases of financial support.

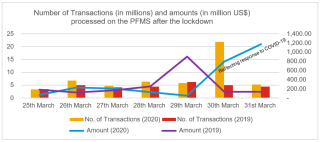

All these relief measures have been consolidated by the government under the “ ” package. Implementation of the package will be tracked through the various schemes and associated account codes in the economic segment of the PFMS. The chart below shown the huge increase in transactions processed through the PFMS in March 2020 compared to the previous year.

Click on the figure for a better image resolution

The human tragedy of loss of life and livelihood in this pandemic is immense. India’s response to the crisis faces many challenges, but the experience so far suggests that (i) social distancing, re-engineering of business processes and flexible use of IT systems have allowed many government officials to work at home, thus protecting them from infection, and (ii) the rapid identification of beneficiaries and quick transfer of emergency funds to bank accounts has lessened the suffering of many government employees, the poor and the informal sector. India’s experience provides useful insights into how similar economies can harness and adapt their PFM systems in times of crisis.

This article is part of a series related to the Coronavirus Crisis. All of our articles covering the topic can be found on our PFM Blog Coronavirus Articles page.

[1] Alok Verma is the IMF’s Resident PFM Advisor in the Kingdom of Eswatini; Anupam Raj is Assistant Controller General of Accounts, Ministry of Finance, Government of India.

[2] PFMS is an integrated IT system implemented by the Office of the Controller General of Accounts.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.