Posted by Lesley Fisher and John Grinyer[1]

Nestled in the east of India, Odisha State, with a population of 42 million and an economy of US$75 billion, is striving to catch up with the better-known States of Gujarat and Rajasthan. India has a federal system of public administration, with around 53 percent of total spending undertaken by States. Over the decades an elaborate set of rules and procedures covering revenue sharing, expenditure limits and joint federal / State level policy initiatives have developed, consistent with rules defined by the Finance Commission[2] and the Fiscal Responsibility and Budget Management (FRBM) Act.

Odisha’s Finance Department takes pride in the fiscal consolidation achieved in the 2000s, with debt reduced from 45 to 15 percent of State GDP (GSDP) and payroll spending slashed from 50 percent of recurrent spending in 1999 to less than 25 percent in 2014. Following these achievements Odisha is now embracing the tenets of modern budgeting by introducing strategic elements to its annual budget cycle. The State is committed to moving away from a budget that is largely a compliance exercise to one with a medium-term perspective, constrained by aggregate and department level budget ceilings and focused on achieving stated policy priorities. These reforms have been supported by the IMF through its South Asia Regional Training and Technical Assistance Center (SARTTAC).

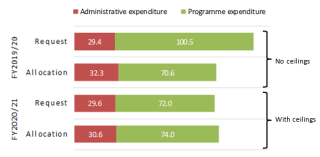

A visible and welcome achievement has been trimming the Budget Call Circular from 34 to only five pages - removing swathes of legacy “this is what we did last year” text that was largely ignored by line departments. Budget ceilings were issued for the first time, removing the ‘wish list’ aspect from the capital (programme) budget (see Figure 1). Another noteworthy innovation has been the collaboration between a local university[3] and the finance department to discuss technical issues such as tax elasticities and macroeconomic forecasting.

Figure 1. Line Department Budget Requests vs Budget Allocations, FY2019-20 and FY2020-21, Rs. ‘000 Crore (Click on the chart for a better image resolution

Source: Budget documents, various years. https://budget.odisha.gov.in/

The most technically demanding aspect of the reforms to date has been constructing a fiscal framework and drafting a fiscal strategy document. The federal system comprises numerous funds, transfers, jointly financed schemes covering both recurrent and capital spending, and a set of rules and ceilings as set out in the FRBM Act. This Act establishes a ‘fiscal anchor’ on which Odisha’s framework can sit – in this case a 3.5 percent of GSDP deficit ceiling, and a 25 percent of GSDP debt ceiling. These limits in turn help to set expenditure ceilings for the budget over the coming three years that can then filter down to indicative ceilings for each spending department.

The Odisha State budget was presented on 19 February 2020 in paperless form (with iPads being handed out to the members of the legislative assembly, saving the paper from an estimated 1,000 trees).[4] The fiscal strategy document was only prepared as a trial run for Fiscal Year 2020-21, making room to improve the document in later years. Key documents like the budget speech, and the fiscal responsibility and budget management statements now include significant graphic illustrations and a discussion of policy issues, in contrast to the lack of analysis characterizing past issues. Whether these reforms will continue in the coming years remains to be seen, but Odisha certainly gives cause for optimism that change is possible with strong political commitment and provides many useful lessons for other Indian States looking to embark on a similar journey.

[1] Lesley Fisher is a resident PFM adviser in SARTTAC. John Grinyer is an independent PFM advisor.

[2] The Finance Commission, established in 1951, defines the financial relations between the central government of India and the individual State governments: https://fincomindia.nic.in/

[3] Centre of Excellence in Fiscal Policy and Taxation, Xavier University, Bhubaneshwar: https://xub.edu.in/ceft/

[4] Budget documents may be downloaded at https://finance.odisha.gov.in/Budget.asp?GL=Budget&PL=1&TL=1&FL=1

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.