Posted by European Commission, DG EuropeAid

The EU is committed to provide Budget Support (BS) to strengthen country ownership, finance national strategies for implementation of the Sustainable Development Goals and promote sound and transparent public finances. BS is a means to use and strengthen country systems and enhance aid effectiveness. Improving public finance management (PFM) is key in BS programmes. The EU has launched in 2015 the “Collect more – Spend better” approach that combines support to fair and equitable mobilisation of domestic revenue with improved public finance management to ensure efficient and accountable execution of public expenditure.

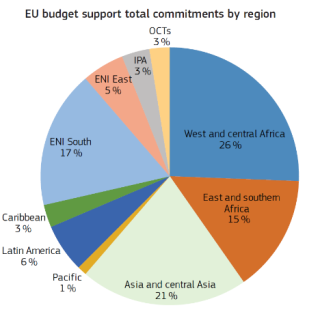

EU budget support is provided exclusively in grants, which is of importance for countries with significant debt burdens. The EU is the world’s largest provider of grant budget support. 250 Budget Support contracts are being implemented in 89 countries with average annual disbursements of EUR 1.8 billion over the past five years. On average, budget support accounts for 40% of our bilateral cooperation programmes with partner countries. Sub-Saharan Africa is the largest beneficiary (41% of total budget support commitments) followed by the European Neighbourhood region (22%), Asia/Pacific (22%) and Latin America/Caribbean (9%).

PFM enters at different levels in BS operations. First, at the level of eligibility - BS is not a blank cheque. Eligibility is constantly monitored and dialogue on progress in PFM is an essential element of all programmes. Four eligibility conditions need to be met:

- a well-defined national or sectorial development or reform policy and strategy;

- a stability-oriented macroeconomic framework (in close dialogue with the IMF);

- good PFM or a credible and relevant programme to improve it;

- transparency and oversight of the budget with budget information publicly available.

The second element is performance monitoring. The Commission generally provides budget support in a combination of fixed tranches (disbursement against eligibility criteria), and variable tranches paid proportionally according to progress in meeting agreed benchmarks. Variable tranches may include specific PFM benchmarks according to a country’s situation. In low-income fragile countries, this may involve improvements of basic budgeting or cash management procedures, or monitoring of budget allocations, notably for social expenditure. In more advanced environments, benchmarks could include improvements in public investment management or the use of competitive procurement procedures.

The third element is technical assistance. EU BS systematically includes accompanying, specialised assistance in areas such as PFM, external control and oversight, statistical systems or sectoral policy development.

EU budget support places close attention to domestic revenue mobilisation and budget transparency. Assistance on strengthening tax administration, improving tax policy and international tax cooperation, notably to fight illicit financial flows and meet good governance standards of taxation, are part of our BS dialogue. Indicators related to domestic revenue mobilisation accounted for 19% of the value of variable tranches approved in 2018 as compared to 3% in 2014. Budget transparency and oversight has become an eligibility criteria on its own since 2012. The EU does not provide BS if the national budget of a partner country is not publicly disclosed. Our programmes aim at progressively improving accountability and access to additional budget information such as execution reports, citizens’ budgets or external audit reports.

The EU’s PFM reform dialogue with partner countries is based on objective and neutral assessments of strengths and weaknesses. The EU is a strong supporter and the biggest funder of the PEFA tool, which has been applied in 151 countries worldwide (January 2020). The EU also cooperates closely with the IMF, the World Bank and other international organisations on PFM instruments and reforms such as the Public Investment Management Assessment (PIMA) tool. In the procurement field, the EU is promoting the Methodology for Assessment of Procurement Systems (MAPS) jointly with the World Bank, the OECD and other donors. Debt management is being strengthened with our support to the World Bank Debt Management Facility (DMF) and the UNCTAD DMFAS debt management tool.

The EU’s experience with budget support is widely recognised. A DEval[1] worldwide Meta evaluation finds broad evidence that BS promotes positive development outcomes in PFM, budget processes and the provision of goods and services. Poverty alleviation has been a constant dimension of EU budget support from the outset. The share of people living in poverty in EU budget support countries has almost halved in 15 years from above 26% in 2002 to below 14% in 2017. The depth of poverty - measured as distance of the poor people from the international poverty line of USD 1.90 a day - has decreased faster in EU budget support countries and is now at the same level as in other countries. BS countries also have a higher and improving degree of control over corruption.

Looking ahead, BS will remain an essential modality to contribute to progress towards all 17 sustainable development goals (SDGs). BS goes hand in hand with investment promotion, financing and guarantees under the European Investment Plan (EIP) to address regulatory upgrades, economic governance or human capital weaknesses. This agenda must be combined with the fight against tax avoidance and illicit financial flows to raise domestic revenue and allow governments to finance their development policies.

[1] What we know about the effectiveness of budget support – Evaluation synthesis, 2017 – German Institute for Development Evaluation.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.