Posted by David Mihalyi and Patrick Heller[1]

National oil companies (NOCs) are economic giants controlling at least $3.1 trillion in assets and producing most of the world’s oil and gas. Many of these companies execute complex projects, provide critical energy infrastructure, and make a big contribution to local employment and state revenues. But NOCs also present important risks to public finance, as we highlight in a new report from the Natural Resource Governance Institute (NRGI), based on a database covering 71 national oil companies worldwide, from 2011 to 2017.

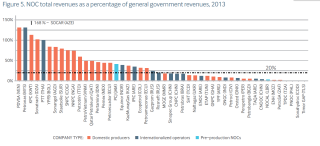

Figure 1 - NOC total revenues as a percentage of general government revenues, 2013 (Click on the figure for a better image quality)

There are at least 25 NOC-dependent countries—states where the NOC collects funds equivalent to 20 percent or more of government revenues (Figure 1). For example, the Nigerian National Petroleum Corporation (NNPC) collects oil and gas sales revenue equivalent to about half the general government revenues. But only a fraction of these resource revenues are transferred to the federal and state governments and count as general government revenues.

The catch-all term “national oil company” in fact encompasses a wide range of entities with varying roles and ambitions. Some are profit-seekers, prioritizing commercial success. Another set of “cash-cows” are focused on collecting revenues from private companies who undertake most of the operations. Yet another group of NOCs undertakes provides a wide range of public services including fuel subsidies, job creation, and social services. In fact, most NOCs do not fit neatly into one category, and our data provide clues for mapping out where companies lie on this spectrum.

NRGI’s database reveals important weaknesses in public reporting by many NOCs. Only 20 of the 71 companies in the sample produced sufficient information on all ten of the most critical indicators we collected. The study shows that companies responsible for 57% of global NOC oil and gas production failed to publish financial statements audited by independent auditors for 2013. For example, the Republic of Congo’s SNPC does not disclose its balance sheet. It was only when its debt became unsustainable that its extent was revealed to the public, pushing the government (which had guaranteed the debt) into a financial crisis.

While NOCs are generally a large source of government revenue, especially in boom times, many also take on large debts. Some borrow to finance new investments, others to meet political agendas, or to maintain large discretionary expenditures. NOC borrowing may take the form of loans from banks (e.g., Ghana’s GNPC) or from other oil companies with which they are working (e.g., Nigeria’s NNPC), oil-backed loans from other NOCs or traders (e.g., Kazakhstan’s KazMunayGas), another government entity (e.g., Sonatrach borrows from Algeria’s Central Bank), or by issuing corporate bonds (e.g., Russia’s Rosneft). Sometimes, NOC borrowing creates benefits. The need to raise market financing and acquire a credit rating can incentivize NOCs to develop strong corporate governance practices. For example, a recent bond issuance by Saudi Aramco provided a unique window into their financial performance.

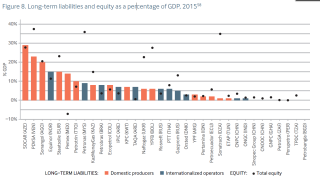

Excessive debt can create significant risks. Figure 2 shows that a handful of NOCs have been carrying very large debt, including Venezuela’s PDVSA and Angola’s Sonangol, companies’ whose debts exceed 20 percent of GDP. Some NOCs are highly leveraged, such as the UAE-headquartered TAQA and Russia’s Rosneft. Mexico’s Pemex stands out as a company where equity is negative. But maintaining a healthy balance of debt to equity is not always enough. PDVSA is unable to service part of its $35 billion of debt, even though it holds much larger assets through equity. Its 335 billion barrels of oil-equivalent reserves are mostly locked underground, and the company was unable to access them as production fell amidst years of mismanagement and the combined impact of the economic crisis and sanctions.

Figure 2 - NOC long-term liabilities and equity as a percentage of GDP, 2015 (Click on the figure for a better image quality)

In a country where the dominant NOC is essentially “too big to fail” the government may ultimately be on the hook for debts incurred, even when the debt is not formally guaranteed by the state. These debts are also treated inconsistently in public reporting. For example, data on public debt for Venezuela and Mexico include the debts of PDVSA and PEMEX, respectively. Yet such debt is not included in the national of Brazil (Petrobras) or Bolivia (YPFB).

Together, a heavy degree of fiscal dependence on the NOC, sprawling quasi-fiscal responsibilities for companies, opacity, and large debt accumulation can create huge budgetary and fiscal risks. The NRGI study recommends that mechanisms of government oversight be strengthened. For example, the IMF should routinely require the disclosure of NOC audited annual accounts (and those of other large state-owned enterprises) as part of its surveillance mandate. And it should also provide clearer guidance as to when to include NOCs in the public accounts, given the mixed roles that many of these companies play. Across oil-rich countries, stakeholders working on PFM should further scrutinize NOCs and support reforms of their corporate and financial governance. We hope that NRGI’s report and the underlying database will make these important tasks easier.

[1] Natural Resource Governance Institute, New York City.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.