Posted by Bruno Imbert[1]

Fiscal Transparency has become a pressing topic in the international agenda over the past years. The sharp deterioration of the fiscal stance that accompanied the 2018 global economic crisis, and the related needs for fiscal adjustment, increased the incentives on Governments to have a comprehensive view of the true state of their public finances. It also revealed the necessity to improve the quality of fiscal information and the need to involve stakeholders outside the ministry of finance.

Along with other international stakeholders, the IMF has engaged in enhancing fiscal transparency by (i) defining international standards for disclosure of information about public finances (Fiscal Transparency Code), (ii) providing detailed guidance on the implementation of the Code’s principles and practices (Fiscal Transparency handbook) and (iii) assessing countries practices through detailed diagnostic analysis (Fiscal Transparency Evaluations).[2]

To help build momentum for further improvements in transparency and to compare and contrast country experiences from francophone Africa, the Fiscal Affairs Department of the IMF co-hosted a regional seminar in collaboration with the European Union and the Senegalese authorities. The seminar was held in Dakar, Senegal from January 31st to February 1st, 2019, and benefitted from high-level participation.[3] It gathered together country representatives from various backgrounds including ministries of finance, parliamentary finance commissions, supreme audit institutions, civil society organizations and NGOs, and donors. The IMF’s Fiscal Transparency Evaluation (FTE) framework was presented, and Senegal showed case the results of its recently-published FTE, the first in Francophone Africa.

Despite recurrent economic and fiscal challenges and a sometimes-difficult political context (e.g., political instability, internal conflicts) francophone countries in Africa have made remarkable efforts to improve fiscal transparency since the early 2000s. The results have been globally positive, as reflected in various evaluations of transparency and good governance, including the International Budget Partnership’s Open Budget Index (OBI).

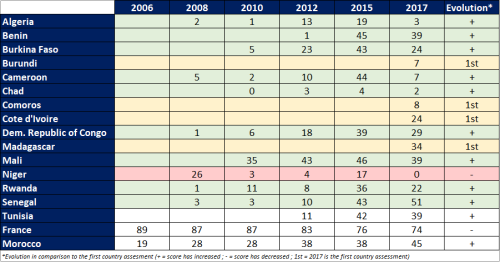

To illustrate, Table 1 summarizes the OBI scores (out of a maximum of 100) for 13 SSA countries over the period 2006 – 2017. Four of these countries were assessed for the first time in 2017, and trends therefore cannot be established. Of the remaining countries, eight (shown in green in the table) showed a significant improvement in their OBI score over the period. Only one country, Niger (shown in red) showed a deterioration. Reasons for these improvements include that substantial amounts of budget and financial information are now shared with the public, and oversight of public finances has also been strengthened. For purposes of comparison, the table also shows the figures for France, Morocco and Tunisia. The worsening of the OBI scores for some countries in 2017 partly reflects changes in the scoring methodology of the index.

Table 1. Summary of OBI Scores, 2006 – 2017

Source: International Budget Partnership (IBP), Open Budget Index, 2017

The following were some of the main takeaways from the seminar in Senegal:

- External evaluations are a powerful trigger to encourage fiscal transparency reforms and progress. Senegal’s presentation of its FTE was complemented by the experience of Tunisia which partly built its PFM reform strategy from an FTE carried out in 2016, and which has led to subsequent improvements in transparency. Representatives from the PEFA Secretariat, the International Budget Partnership (IBP), and the Global Initiative for Fiscal Transparency (GIFT) also presented the results of their evaluation frameworks and how these have encouraged improvements in transparency.

- Sharing experiences and good practices through peer learning is critical for countries facing similar challenges. Examples of recent initiatives taken by the countries represented at the seminar were showcased. These initiatives included (i) improvements in budget documentation and in the public accessibility of fiscal information (Benin); (ii) identification of fiscal risks and mitigation measures (Côte d’Ivoire, Madagascar); and (iii) enhanced fiscal transparency for natural resources (Guinea). The participants agreed on the value of establishing mechanisms for the regular exchange of information among countries on technical and institutional aspects of fiscal transparency.

- The PFM community has an important role to play in encouraging governments to increase their efforts to improve transparency. Civil society organizations, supranational organizations such as the WAEMU Commission, state legislatures, supreme audit institutions, and donors can encourage national governments to disclose more fiscal information in an accessible and user-friendly form and influence decision-making on public finance. They can also help make governments accountable for the decisions they take on fiscal policy, the efficient and effective allocation of resources through the budget, and the results achieved.

The seminar received very positive feedback from participants who called for a repeat exercise. They identified several areas where quick wins could be achieved, such as the dissemination of key fiscal documents, more comprehensive fiscal reports, and improved integrity of fiscal data. This could lead to periodic follow-up to ensure governments keep up the pace of reforms and commit to no turning back.

[1] Economist, Fiscal Affairs Department, IMF.

[2] For further information see: http://www.imf.org/external/np/fad/trans/

[3] Opening remarks were made by the Senegalese Finance Minister (M. Amadou Ba), the head of the EU delegation in Dakar (Ms. Irene Mingasson), the Director of the Fiscal Affairs Department of the IMF (Mr. Vitor Gaspar, remotely), and the IMF Resident Representative in Dakar (Ms. Cemile Sancak). The Senegalese Deputy Minister for Budget, M. Birima Mangara, gave the closing speech.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.