Posted by Natalia Sclearuc, Johann Seiwald and Eivind Tandberg[1]

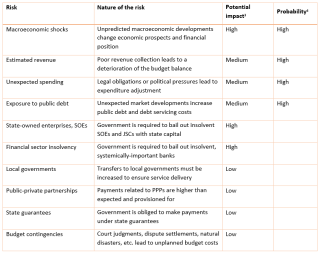

Moldova published its first Fiscal Risk Statement (FRS) in December 2017[2]. The FRS provides a comprehensive overview of key fiscal risks facing the country, and is a useful tool for assessing the consistency and credibility of fiscal policies. Whereas much of this information has been available from various sources in the past, the consolidated presentation allows for assessment of the relative importance of each risk category, and provides a basis for prioritizing risk mitigation measures. The table presents the key fiscal risks in the FRS.

Table. Main Fiscal Risks in the FRS for the 2018 Budget (Click on the table for a better image resolution)

The FRS indicates the potential impact of all major fiscal risks and assesses the likelihood of the most direct risks. Given the uncertainty regarding implicit risks and contingent liabilities, such as the likelihood of SOE insolvency or financial sector bailouts, as well as the risk of providing adverse incentives for the performance in these sectors, the Ministry of Finance (MOF) did not assign probabilities to these risks. This policy might change in the future, as the MOF’s capacity for undertaking risk analysis develops further.

An early draft of the FRS was subject to public consultation, together with other budget documents, and the MOF received questions on the FRS from Members of Parliament. Over the last year, the MOF has taken several steps to establish more proactive monitoring and oversight of fiscal risks, including those related to SOEs, local governments, and PPPs. The FRS gives the MOF a more robust platform to raise fiscal risk issues with other institutions, and to require that they provide adequate data and analysis of these risks. The impact of the FRS on fiscal policy formulation should become more visible in future budget cycles.

The MOF plans to further improve the analytical content of the FRS during 2018 and 2019. This will include more explicit modelling and scenario analysis related to the explicit fiscal risks, including estimates for GDP, revenues, expenditures and debt. It will also be possible to develop more comprehensive analysis of fiscal risks related to state enterprises, local governments, and PPPs, by making use of existing information and increasing the analytical capacities of the divisions monitoring these risks. During 2019, the MOF also plans to develop the FRS to incorporate stress-tests for key fiscal parameters.

[1] Natalia Sclearuc is the Head of the Budget Synthesis Department of the Ministry of Finance in Moldova, Johann Seiwald is a Senior Economist at the IMF’s Fiscal Affairs Department, and Eivind Tandberg is a fiscal expert at Vista Analysis, Norway.

[2] The FRS can be found in Romanian under http://mf.gov.md/ro/content/proiectul-legii-bugetului-de-stat-pe-anul-2018. FAD provided technical assistance with financial support from the Government of the Netherlands.

[3] High indicates a possible impact of more than 3 % of GDP, medium 1 – 3 %, low below 1 %.

[4] High indicates a probability of more than 30 %, medium 10 – 30 %, low below 10 %.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.