Posted by Ian Lienert1

In the Open Budget Surveys (OBSs) published prior to 2015, the average overall score of francophone countries were quite a lot lower than those of comparable non-francophone countries. This led some French-speaking observers to remark that the OBS is biased against francophone countries.

Is there any validity in this claim? Are there specific features of francophone countries’ PFM system that are not captured in the OBS, or which lead to bias?

A new study considers these questions, by examining:

- The trends in budget transparency in francophone countries to 2015.

- The main factors contributing to the level of fiscal transparency.

- The specific features of francophone countries that may, or may not, contribute to bias in OBS results.

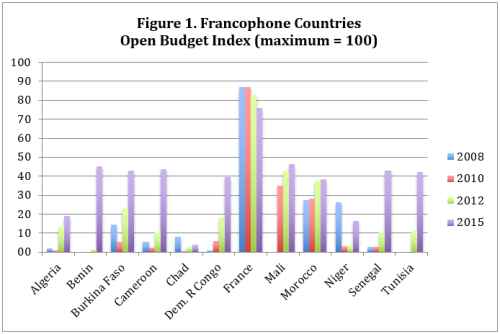

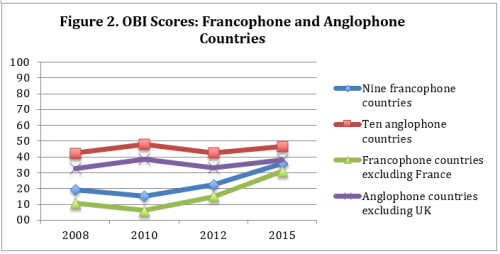

The study concludes that there is no systematic bias in the OBS methodology that favors non-francophone countries. It observes that France, unlike African francophone countries, has consistently provided extensive budget information to the public, but that the performance of these African countries has improved recently (Figure 1). Moreover, the average gap between francophone and comparable anglophone countries has narrowed sharply since 2010 (Figure 2).

The research was based on data available up until the 2015 OBS. In the 2017 OBS, which will be published on January 30, 2018, it will be of interest to observe whether the gap in OBI scores between francophone countries and comparable non-francophone countries closed further. The analysis of 2017 OBS will be enriched by the addition of five new francophone countries, namely Burundi, Canada, Comoros, Côte d'Ivoire and Madagascar.

In the meantime, based on the 2015 OBS, francophone countries published more budget planning documents than comparable anglophone countries (37 versus 34 documents), whereas anglophone countries published more year-end and external audit reports (31 versus 18 documents).

The study also compares the performance of francophone countries against African lusaphone countries and various Asian countries. It observes that budget transparency of most francophone African countries in 2015 was higher than that of Cambodia, China and Vietnam, while lower on average than the Asian countries of British inheritance.

Five main determinants of fiscal transparency are discussed in the report. The importance of these influences in francophone countries relative to comparable anglophone countries in 2015 appears to be:

- A negative influence emanating from the fact the francophone countries had, on average, less political freedom than comparable anglophone countries.

- A negative influence because the OBS sample of francophone countries includes two oil/gas producers with limited political freedom (Algeria and Chad), whereas only one oil producer (Nigeria) adversely impacts the anglophone countries’ average OBI score.

- An inconclusive influence of national income on budget transparency.

- A diminishing influence of administrative culture on fiscal transparency.

- Little influence coming from fragile state status.

Other factors that could help explain the recent improvement in the performance of francophone African countries include:

- New laws on fiscal transparency. In recent years, there has been widespread adoption of new laws on fiscal transparency (WAEMU/CEMAC countries) and/or for the budget system (“organic budget laws”). Partly because of these laws, the political leaders of countries such as Benin, Burkina Faso, the Democratic Republic of Congo, and Senegal gave the go-ahead to publish key budget documents that were previously produced but not disclosed.

- A “demonstration effect” – to catch up with an early regional leader, Mali.

- External pressure from civil society organizations, international organizations, and budget aid providers. Conditional budget support appears to have induced some francophone countries to publish more budget documents.

The report finds no evidence that special features of the francophone countries’ budget and PFM systems – such as differences in their accounting systems and year-end closing and settlement procedures – lead to possible bias against them. Francophone countries generally have low human and material capacity to prepare key budget documents, but other low-income countries also suffer from this constraint. Moreover, the number of staff in francophone African countries’ finance ministries tends to be higher than in other low-income African countries.

In addition, the study finds that some specific features of francophone countries’ PFM system favor budget transparency relative to non-francophone countries. These include:

- A clear legal framework, including for budget preparation and enactment.

- Clear provisions for budget classification, medium-term projections, budget programs and performance information, and detailed budget documentation.

- Centralized procedures for budget execution and accounting, which facilitate the preparation of reports on aggregate fiscal developments.

The study also notes that francophone countries are not unique in needing to change their legal framework prior to adopting budget reforms that enhance budget transparency. Many continental European countries, Russia, and Latin American countries also have a similar “legal framework first” mind-set. The lack of political willingness to publish budget information in some francophone countries is also replicated elsewhere, notably in one-Party States such as China and Vietnam, and in non-democratic oil-producing Middle East countries.

In summary, the paper does not find any evidence for systematic bias in the OBS against francophone countries, neither from these countries’ unique features of their PFM systems, nor from survey question or statistical biases.

1Ian Lienert is a former staff member of the IMF’s Fiscal Affairs Department. He is now a consultant in public financial management, based in Toulouse, France.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.