By Tom Neubig and Agustin Redonda1

Tax expenditures (TEs) are used by governments around the world to promote public policy objectives. Examples include tax deductions on mortgage interest to encourage home ownership and preferential tax treatment of pension savings.

TEs are offered in many shapes across the entire tax system. They provide subsidies through reduced tax rates, tax exemptions, exclusions, deductions and tax credits. They are applied to income taxes, value added and sales taxes, payroll taxes, property taxes as well as estate taxes. And they target policy goals in areas as diverse as energy, housing, research and development, retirement, health as well as specific business sectors.

TEs are not only widespread, but also costly. In the United States, the federal government is estimated to forego more than 1.4 trillion USD in 2016 (36% of direct government spending and 7.5% of GDP). In the UK, TEs amounted to 117 billion GBP in 2015 (20% of central government spending and 5.7% of GDP). IMF estimates suggest that TEs in African economies are also significant, ranging between 3.3% and 7.5% of GDP. Likewise, on average, TEs in Latin America amount to 3.5% of GDP, ranging from 0.7% in Colombia to 6.6% in Dominican Republic.

Tax incentives are frequently one of the most contentious topics in fiscal policy agendas. Major tax reforms generally involve significant reductions in TEs accompanied by lower marginal tax rates, a combination that reduces economic distortions and stimulates economic growth. It is also likely to reduce inequality, as many TEs are “upside down” subsidies, providing larger benefits to higher income families than to low and middle-income households. TEs currently play an important role in tax reform in many countries, such as Argentina, France, Switzerland, and the United States.

Reducing the number and magnitude of TEs is often seen as an improvement in the tax system as it: i) simplifies the tax code and ii) broadens the tax base. The latter is crucial for developing economies, as domestic revenue mobilization is a key determinant of economic development. Moreover, TEs for investment in developing countries are often found to be ineffective, inefficient and associated with abuse and corruption. Likewise, the Compact with Africa – a G20 initiative to promote private investment and investment in infrastructure in Africa – highlights the importance of an investment-friendly tax system to boost private investment, but explicitly calls for avoiding a proliferation of costly TEs.

TEs are generally open-ended entitlements and – despite having the same effects as direct government spending – are not administered or enforced to the extent of other government spending programs. Moreover, in spite of the prevalence of TEs worldwide, there is a striking inconsistency and incompleteness in official TE reporting. Adam Corlett points to the “world of difference between the scrutiny of expenditure and that of tax expenditure” that exists in the UK, even when both policy instruments are used for similar objectives and their effects on the budget and on income distribution are equal. In the EU, only 18 out of 28 Member States report regularly on TEs with reporting practices varying widely among them in terms of scope and depth of their reports. Agustin Redonda highlights the alarming situation in Switzerland, where the latest official report on federal TEs dates back to 2011, and is based to a significant extent on 2005 figures from the canton of Bern, extrapolated to the rest of the country. Valérie Segond provides a sobering account for France. Similarly, only a few African countries publish figures on their TEs, and in the East Asia and Pacific region, only the Philippines and Papua New Guinea compute and report TE estimates.

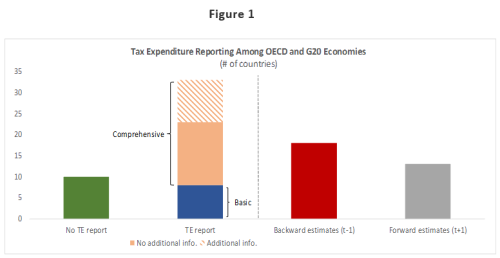

Against this backdrop, the Council on Economic Policies (CEP) seeks to increase transparency, expand research by building the first Global Tax Expenditures Database (GTED). This will help to establish a foundation for more broader and robust policy debates regarding TEs. Preliminary insights from the project show the heterogeneity in TE reporting across the 43 OECD and G20 countries (see Figure 1: click on image to enlarge).

• Number of countries not reporting on TEs at all: 10 out of 43

• Countries with a regular, comprehensive and detailed report of TEs: 25 out of 43

• Countries with time series in their reports – for at least the previous year: 18 out of 43

• Countries providing forecasts – for at least the next year: 13 out of 43

• Countries providing additional information for at least some TEs, i.e. moving beyond simple revenue foregone estimates to include, e.g. cost-benefit analyses, distributive assessments, estimates based on other methods than the revenue foregone such as the outlay equivalent method: 10 out of 43

These preliminary figures provide a rough picture of the substantial differences in TE reporting within the OECD and G20. At the same time, they give a flavour of the scope that there is for improving transparency and analysis on TEs. International cooperation can be an important catalyst for change. For example, the OECD’s comprehensive and consistent reporting on the amount of fossil fuel subsidies including TEs, has been crucial for the climate change debate.

Estimating and reporting the revenue foregone through TEs is a time and resource intensive task, and not without significant methodological issues ( e.g. with regard to benchmarking). At the same time, sound reporting on TEs is a necessary (although not sufficient) condition for the implementation of comprehensive assessments that move beyond fiscal cost estimates, and which are, in turn, crucial to increase the effectiveness and fairness of tax systems worldwide. Improving TE reporting will help individual countries better design their tax systems and structure more effective government incentives. It will also allow them to identify best practices in the use of TEs from around the world and thus have positive spill overs to other countries’ policymaking. The GTED shall provide a platform for a joint initiative to make this happen.

1Tom Neubig is a Senior Associate on fiscal policy with the Council on Economic Policies (CEP). He is also a founding member of the taxsagenetwork.com. Agustin Redonda is a fellow with the Council on Economic Policies (CEP), where he runs the Fiscal Policy Program

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.