Posted by Sandeep Saxena[1]

A new paper on “How to Strengthen the Management of Government Guarantees” has been published by the IMF. The paper highlights commonly observed weaknesses in the management of government guarantees, describe good practices, and discuss measures governments could take to strengthen this often-neglected area.

Guarantees are contingent liabilities that can expose the issuing government to significant fiscal risks.  Governments provide guarantees to both public and private entities, primarily with the objective of providing the beneficiaries with access to cheaper credit, or to improve the viability of projects with significant social and economic benefits. Guarantees do not involve immediate cash outflows from the budget, but they expose the government to the risk of future cash outflows. The timing and amount of such cash flows are often difficult to estimate.

Governments provide guarantees to both public and private entities, primarily with the objective of providing the beneficiaries with access to cheaper credit, or to improve the viability of projects with significant social and economic benefits. Guarantees do not involve immediate cash outflows from the budget, but they expose the government to the risk of future cash outflows. The timing and amount of such cash flows are often difficult to estimate.

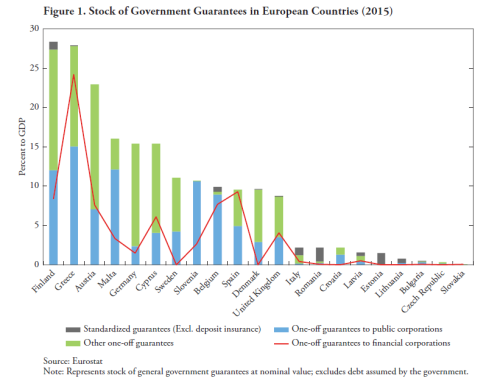

Countries that have accumulated a substantial stock of guarantees face the risk of a fiscal shock, as governments may lack adequate budgetary provisions to service the obligations arising from invoked guarantees. These risks are exacerbated during times of fiscal crisis because macroeconomic shocks trigger realization of contingent liabilities.

Despite the risks involved with guarantees, their management often remains weak. The use of guarantees is not always economically efficient, and guarantees may not always be the most efficient instrument for public support. Guarantees are often used to subsidize, in a nontransparent manner, beneficiaries and projects that governments favor. Often governments use guarantees to circumvent budgetary constraints. There is seldom an assessment of the risks involved or any upfront recognition of the potential losses that guarantees may cause. Being off-budget, guarantees often escape the usual scrutiny, including legislative scrutiny, that applies to conventional expenditure decisions.

Unless issued prudently and managed effectively, when called, guarantees can cause a substantial burden on the budget, resulting in large unanticipated cash outflows and increased debt.

The paper recognizing that the use of guarantees for policy priorities is a political choice, and emphasizes the importance of developing technical capacity and processes to support informed decision making. Citing examples from a variety of countries on different aspects of guarantee management, the paper provides a generic framework for the evaluation of guarantee proposals; discusses techniques for assessing and quantifying the risks from guarantees, and measures for their mitigation; and describes good practices in the budgeting, accounting, reporting, and monitoring of guarantees.

The management of guarantees is often weak in many developing and low-income countries. This paper provides a framework which will help the authorities in these countries strengthen their institutional capacity, and a useful tool for PFM practition ers in supporting this work.

The paper is available at http://www.imf.org/en/Publications/Fiscal-Affairs-Department-How-To-Notes/Issues/2017/10/19/How-to-Strengthen-the-Management-of-Government-Guarantees-45201.

[1] Senior Economist in the PFM II Division of the Fiscal Affairs Department, IMF.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.