Posted by Gerardo Uña[1]

Financial Management Information Systems (FMIS) are comprehensive systems that support the preparation and execution of the budget, accounting and financial reporting, and many other public financial management (PFM) functions. They are used to integrate budgetary, accounting, treasury, and public debt management processes, and to generate a country’s in-year fiscal reports and annual financial statements. As well as producing timely, relevant, and reliable financial data, well-designed FMIS can play a critical role in improving the quality of public expenditures and fiscal transparency.

After three decades of FMIS implementation across different regions, such as Latin America, Africa and Asia, many countries have initiated a process of modernization to improve the functionalities, coverage, and integration of their systems. However, the cost and implementation challenges of these reforms have been very large, leading to disappointing results in many cases. For these reasons, countries are looking for new ways of designing FMIS that make the best use of modern technology to integrate functions and processes efficiently and cost-effectively.

A report published by the World Bank in 2011[2], provided much useful information about the characteristics of FMIS developed over the previous 25 years, and the challenges of implementing them. More recently, the Bank has taken this work a step further in a paper on “A Diagnostic Framework to Assess a Government’s Financial Management System”[3] (click to open paper). This paper provides a diagnostic framework for assessing FMIS performance based on five dimensions and 36 indicators. The dimensions are:

- Treasury Single Account (TSA) status: related to the degree of consolidation of government cash balances and the extent to which they are under the direct supervision of the state treasury.

- FMIS coverage: a proxy to measure the extent to which financial transactions are registered in the information system.

- FMIS core functionality: an assessment of central functions such as the internal control of budget execution and treasury processes.

- Ancillary features: includes the FMIS’s interfaces with other information systems, such the management of government payroll and debt management.

- Technical aspects: covers issues such as the system’s IT architecture and the use of a data warehouse.

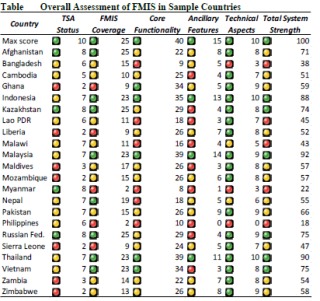

The paper applies the framework to a sample of 22 countries in Africa (for example, Ghana, Mozambique, and Zimbabwe) and the Asia-Pacific region (for example, Cambodia, Malaysia, and the Philippines). The sample of countries covers both low-income countries, and emerging markets. The results of the analysis, which are summarized in the table below, result in a score for each dimension and for the Total System Strength (TSS), which receives a maximum score of 100 points. The paper also explores the relationship between the TSS score and the PEFA score for the same group of countries.

The main findings of the study, based on the summary provided in the table are as follows:

- The average TSS score is 58 points, but the range extends from 18 points (the Philippines) to 92 points (Malaysia). Most countries receive only medium or low scores for the dimensions on TSA status, FMIS coverage and FMIS core functionality, which pull down their overall rating.

- Especially weak areas identified in the study are that in many countries: (i) the recording of financial transactions in the information system is not timely; (ii) government cash balances are not consolidated in a TSA, and are not subject to direct state treasury supervision; and (iii) many of the core functionalities of the FMIS are not utilized fully, if at all. These weaknesses seriously undermine the overall performance of the FMIS as a budget management tool.

Based on this analyses, the paper concludes that, in many developing countries and emerging markets, further reforms would be most effective if they focus initially on expanding the coverage of the TSA, and the timely recording of all financial transactions by the FMIS, rather than investing in new IT platforms and technological enhancements.

Nonetheless, there are other important factors that should be taken into account in improving FMIS performance. It has long been recognized, for example, that an FMIS should be based on a well-crafted conceptual design[4]. As the earlier World Bank study recognized, insufficient attention is often paid to the prioritization and sequencing of FMIS implementation, and to the importance of strong leadership, secure financing, and good project management. Similar conclusions are reached in a recent study of FMIS development in Latin America[5], which also highlights the importance of the political economy context, adequate testing of the systems before they are implemented, and a cost-effective maintenance strategy.

Finding different paths to increase the effective use of FMIS in a country’s budget management and decision-making processes is a continuous challenge for policy-makers, practitioners, and their technical advisors. To tackle this challenge requires new and innovative approaches based on a solid diagnostic assessment of existing needs and practices, effective leadership, sound projects management, and the effective use of the latest technological developments. These issues will be developed in a follow-up article.

[1] Technical Assistance Advisor, PFM M2 Division, Fiscal Affairs Department, IMF.

[2] C. Dener, J. Watkins, and W. Dorotinsky, 2011, “Financial Management Information Systems: 25 Years of World Bank Experience on What works and What Doesn’t.” World Bank, Washington DC.

[3] Hashim, Ali and Moritz Piatti. 2016. "A Diagnostic Framework to Assess the Capacity of a Government's Financial Management Information System as a Budget Management Tool." Independent Evaluation Group. World Bank, Washington, DC.

[4] A Khan and M. Pessoa, 2010, “Conceptual Design: A Critical Element of a Government Financial Management Information System” TNM 10/07, FAD, IMF, Washington DC.

[5] C. Pimenta and G. Uña, 2015, “Integrated Financial Management Information Systems in Latin America: Strategic Aspects and Challenges”, in C. Pimenta and M. Pessoa (eds.), Public Financial Management in Latin America: The Key to Efficiency and Transparency.” IMF- Inter-American Development Bank, Washington DC.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.