Posted by Jason Harris[1]

Increasing public investment is one of the more common pieces of advice given to countries over recent years, particularly in the presence of economic slack and low interest rates. In these conditions the short-term boost from increased demand adds to long-term benefits from increasing productive capacity.

But while increasing investment is relatively easy to recommend in aggregate terms and at the political level, when it comes to the nuts and bolts of project selection, approval and execution, problems abound. This is particularly so when premature commitments are made before a full project assessment has been done, resulting in cost blowouts and implementation delays.

A recent study by the Grattan institute on Australian transport infrastructure over the past 15 years sheds light on where these issues arise and why[2]. The study finds that:

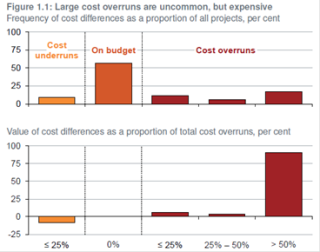

- Cost overruns of infrastructure projects are about one quarter above the estimated cost.

- But, contrary to common perceptions, the vast bulk of projects come in close to their initial costs – it is just that a few large projects exceed their estimated cost by a spectacular margin (see chart below).

- These huge cost blowouts usually relate to projects that are announced without sufficient planning and evaluation being done in advance, often as big political tickets at election time.

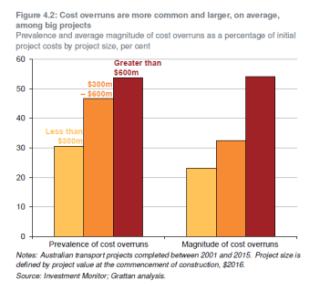

- The bigger the project, the more common and larger the cost overruns.

- Common reasons cited for cost blowouts: specification changes and problems associated with land acquisition, played a relatively minor role.

(click to enhance image)

Most projects are fine, but | Cost blowouts of big projects are |

|  |

Some interesting aspects of the study are that it:

- Considers the entire population of 863 transport projects worth over 200 million Australian dollars since 2001. Such comprehensive coverage is relatively rare in the literature, where only a small (and potentially skewed) set of project data is usually available.Some interesting aspects of the study are that it:

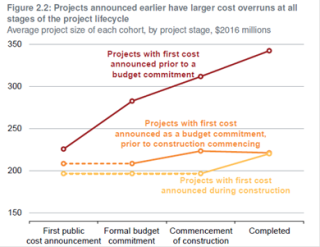

- Tracks projects from the initial policy commitment all the way to completion, allowing an analysis of where in the project cycle cost blowouts occurred (see chart below).

- Includes a number of interesting case studies, detailing political problems, cost shifting among levels of government, and ribbon cutting ceremonies on uncompleted roads.

- Provides all data underlying the analysis, which are available for public use.

The study underlines the importance of rigorous project assessment before committing to infrastructure projects, as recommended in the IMF’s Making Public Investment More Efficient policy paper, published in 2015.

This is particularly so because of the finding that projects committed to before assessments are done find themselves continuously behind the eight-ball, with difficulties continuing to build throughout both the design and execution phases of the cycle. Even where these cost blowouts are identified during the planning (but post commitment) phase, they are rarely dropped, despite the changed cost-benefit calculus. This points to the strong inertia and political underpinning that surround many big infrastructure projects. (click image to enhance)

Uncosted election commitments are largely to blame for costs blowouts, with |

|

Just how to rein in these premature political promises is an open question. Bipartisan commitment to a rigorous evaluation process is one answer, though this self-restraint is all too often forgotten in the heat and passion of election campaigns.Australia is often held up as a model of public financial management practice. The fact that most projects that go through a thorough assessment process are executed on budget supports this argument. The Grattan Institute study suggests, however, that the exigencies of political promises will in some (very costly) cases overwhelm proper policy considerations, resulting in real costs to the public finances.

[1] Economist, Public Financial Management Division 1, Fiscal Affairs Department, IMF.

[2] Terrill, 2016, Cost Overruns in Transport Infrastructure, Grattan Institute.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.