Posted by Xavier Rame, Delphine Moretti, and Esther Palacio[1]

The IMF has recently published a Fiscal Transparency Evaluation (FTE) report for Mozambique. (English/Português) This evaluation was the first to be undertaken in Africa. It shows that Mozambique has made substantial progress in making fiscal information available to the public, but highlights the scope for improvements to the budget documentation and fiscal reports, and further transparency on fiscal risks. The Mozambique FTE is one of ten pilots of the IMF’s new methodology for assessing countries’ fiscal transparency practices, and should help build a more complete picture of governments’ financial accountability practices around the world.

For many years, the government of Mozambique has engaged in a series of reforms aimed at improving the country’s public financial management (PFM). As part of this effort, the government requested the IMF to help them prepare an FTE report. The objective of this study was to assess Mozambique’s performance in terms of the relevance, clarity, reliability and completeness of its published fiscal information. Based on the results of the FTE, the government has defined a set of achievable milestones to improve fiscal management, and increase the government’s accountability towards the public.

The FTE report recognizes the progress that Mozambique has made in strengthening fiscal disclosure over the past years. It notes that basic practices of fiscal reporting have progressively been implemented. Fiscal information is published regularly and on a timely basis, and is audited by the Tribunal Administrativo, Mozambique’s independent supreme audit institution. However, while broadly consistent with the legal requirements, the coverage of financial data communicated to the public is limited. For example, no information is provided on the current value of the government’s equity investments that are estimated at around 22 percent of GDP, and little information is communicated on the financial situation of public sector entities outside of the budgetary central government. Improving the coverage and reliability of fiscal reports remains a major challenge in Mozambique.

In the area of fiscal forecasting and budgeting, the country meets most of the FTE’s good and advanced practices. The budget process is comprehensively regulated by the PFM Law (so-called SISTAFE Law) and related regulations. A defining feature of budgeting in Mozambique is its openness and accessibility. All the main budget documents are published and available on the Internet, and efforts are made to provide a summary of this information to citizens. This commitment to openness could be further strengthened through improvements in the presentation of policy issues in the budget documents, such as the reasons for decisions by the government on the allocation of resources to different sectors.

The section of the report on fiscal risks analysis and management appears as the weakest area of the evaluation. In particular, the report notes the lack of public information on fiscal risks and the government’s strategy to mitigate such risks. It discusses the areas where the largest risks may arise. These include public investment projects, price subsidies, government guarantees, and pension benefits, as well as the government’s exposure to volatility in the prices of natural resources.

The report includes a sequenced fiscal transparency action plan, over the next 5 years, to enhance the information for fiscal decision-making and ensure that Mozambique keeps pace with evolving international transparency standards and practices. The plan is focused on the most critical improvements, in the specific context of Mozambique, such as: (i) the inclusion of autonomous institutions in the fiscal reports established by the government; (ii) the publication of underlying assumptions for establishing fiscal forecasts; (iii) the provision of better information on the government’s projections of natural resources revenue under alternative price scenarios; (iv) the adoption of fiscal rules to manage these revenue flows; and (v) disclosure of information on the financial performance of public corporations, as well as the financial support provided by the government to these entities.

Background Note on FTEs

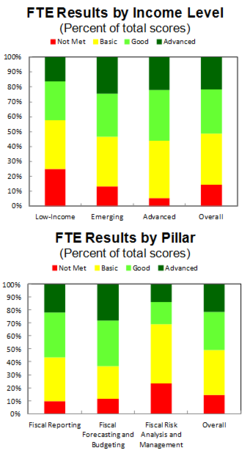

FTEs are the Fund’s principal instrument for evaluating the transparency of countries’ fiscal reports (pillar I), forecasts (pillar II), and risk management (pillar III). Work is underway to develop a fourth dimension on natural resources (pillar IV). The evaluations examine the extent to which a country’s published fiscal information provides a complete and accurate picture of its fiscal position, prospects, and risks. The ten pilot assessments that have been undertaken so far include countries in several regions, and with a wide range of income levels. Results of these evaluations show that basic practices are met on most of the Code’s transparency principles, with good and advanced practices being achieved by emerging and advanced economies on more than half of the principles. Overall, good and advanced practices are most likely to be met on fiscal reporting and budgeting, while the ratings on the analysis and management of fiscal risks are generally poorer (see attached charts).

[1] Xavier Rame is a Senior Economist and Delphine Moretti is a Technical Assistance Advisor, in PFM2 Division, Fiscal Affairs Department, IMF; Esther Palacio is a Technical Assistance Coordinator for the IMF, in Mozambique.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.