NewsFlash - Feedback from stakeholders to the draft upgraded indicator set

On August 7th 2014, the PEFA Secretariat invited comments from stakeholders on the draft of the upgraded PEFA indicators’ set. By the close of the public consultation period at the end of October, 74 written submissions had been received from a variety of stakeholders.

The PEFA Partners are extremely grateful for the valuable feedback and suggestions from stakeholders on the upgraded PEFA set. The Secretariat is compiling a summary of the responses to the comments, which will be published in January 2015.

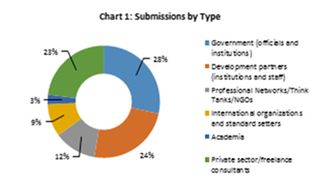

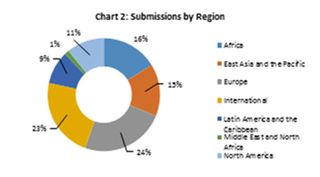

Chart 1 shows that the extent of feedback is quite balanced among four groups: government practitioners; donor officials; private sector consultants/assessors; and a group comprising standard setting institutions, professional networks, think tanks, academia and research institutions. The distribution of comments across regions is also diverse, with the majority of comments from Europe, followed by international bodies, Africa, East Asia and the Pacific, and North America.

The feedback received both in terms of number of submissions received and variety of respondents, highlights the diversity of interest in improving the PEFA Framework.

The submissions contained several hundred specific comments on various aspects of the proposed changes to the indicators. Many comments focused on the proposals for the three new indicators (Credible Fiscal Strategy, Public Investment Management and Public Asset Management) and the substantial changes proposed to the revenue and service delivery indicators (PIs-13-15, and 23). Many comments were also received on the changes associated with arrears and donor practices. Almost two thirds of all submissions included general comments.

Main subjects raised by the public consultation responses

The consultation feedback has highlighted many issues and provided concrete proposals for improvement of the final version of the upgraded PEFA Framework. The main subjects that emerged from the consultation responses were:

1. Strong support for the relevance of the new or revamped indicators - Credible Fiscal Strategy, Public Investment Management, Public Assets Management, Revenue Budgeting and Efficiency in Service Delivery with suggestions on how to improve the formulations further.

2. Strong support for the change of ‘D’ scores requirements to a standard default.

3. Emphasis on the need for transition arrangements – the need for transition arrangements such as explanation of the rationale for the changes made, availability of training and guidance material, cut-off date and resource requirements for future assessments. These types of transition issues will be addressed in the guidance to be prepared by the PEFA Secretariat.

4. Coverage of Debt Management – several respondents raised the concern that removal of the indicator and dimensions on expenditure arrears, debt sustainability analysis and control over debt and guarantee issuance has significantly reduced the prominence of debt management in the Framework. The draft Framework was based on the introduction of the new indicator, Credible Fiscal Strategy, and the refinement of two existing indicators. However, given the feedback, the Framework will be further revised by strengthening the debt management content, i.e., by re-incorporating debt management information and the quantitative aspects of expenditure arrears (in the new CFS and proposed PI -17).

5. Coverage of Donor Practices – a number of respondents raised questions about the changes related to the donor indicators. In considering these questions, it is considered that the proposed approach of including the information related to donor grants is best incorporated into the revenue indicators. The impact of donor practices on government systems and outturns also will be highlighted in the narratives in relevant indicators and within the performance report. It also is noted that since the introduction of PEFA, more comprehensive assessments of donor practices have been developed in response to the Paris Declaration and the Busan Partnership for Effective Development Declaration. The Global Partnership monitoring framework provides a mechanism for monitoring performance against the ten indicators encapsulating Busan partner commitments. Users of the upgraded PEFA Framework may choose to supplement the assessment with information on the Global Partnership monitoring framework.

6. Coverage of Transparency and Public Participation – some responses have suggested expansion of transparency issues and public participation. Public access to information and public influence through the legislature were strengthened in the upgraded Framework through incorporating important aspects of transparency from other specialized instruments, such as the Fiscal Transparency Code and the Open Budget Survey. Guidance will suggest that reference to legal and institutional arrangements and results of other related assessments be included in section 2.4 of the PEFA report.

The next steps –testing of the upgraded PEFA framework

Responses to the three main issues emerging from consultation as described above, are being addressed in a revised version of the PEFA Framework which will be released for testing in January 2015. Other minor refinements to the indicators and guidance based on the feedback and testing to-date also will be included in the revised version.

Testing will be carried in the first half of 2015 with the aim of further refining and issuing the final upgraded PEFA Framework by the end of 2015.

The PEFA Partners are seeking additional opportunities to test the upgraded Framework. If you would like to participate in testing the PEFA Framework, please contact the PEFA Secretariat.

Public Expenditure and Financial Accountability (PEFA) ● www.pefa.org ● services@pefa.org

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.