Posted by Racheeda Boukezia and Benoit Taiclet1

March 2012, Bamako, Mali:

Following insurgency and terrorism in the northern regions, civil strife and a garrison mutiny nearby Bamako, a military junta takes power, suspends constitutional order, thus triggering international retaliation. Soon after, the BCEAO -– the regional Central Bank for West African countries -- suspends transactions on behalf of the Malian government and, by doing so, chokes off the bulk of government spending. The Malian Treasury has no option but to reroute key payments through a number of commercial banks. By late 2012, not only is money scarce but it is also dispersed among more than 3,400 bank accounts. Although the transitional government laboriously succeeds in paying wages and making a few other mandatory payments, it is unable to optimize its use of cash and mobilize all idle funds. Is this the end of the would-be Treasury Single Account (TSA)?

September 2014, BCEAO and Treasury meet with the IMF mission in Bamako:

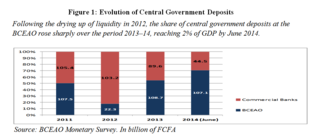

BCEAO and Mali Treasury have been working as a close-knit team to resolve cash management issues. The TSA is operational. It now embraces the bulk of central government deposits (see Figure 1). Commercial banks still handle some marginal deposits, mostly related to externally-financed projects and mandatory deposits or sequesters from former government obligations. A cash management committee meets on a weekly basis. Domestic arrears have dramatically decreased by two-thirds of the post-crisis (January 2013) level. And the Malian Treasury is covering temporary cash needs with a successful short-term T-bill issuance program.

What accounts for such an achievement? This article describes a highly successful, yet non-typical, story about how to transform the management of government money with little or no effect on the stability of the financial sector.

Why should Malian money be put together in the same purse?

Establishing a unified structure of government bank accounts is an important precondition for improving cash management and control, and budget monitoring. Such a reform is particularly important in emerging and low-income countries, where authorities are facing, inter alia, severe fragmentation of their funds and liquidity, weak control of these cash resources due to an inadequate reporting system, and consequently very poor budget execution. Governments are sometimes unaware of the sheer scale of unreported cash resources held by commercial banks, forcing them to incur significant borrowing costs from the same banks.

How did it happen before and after the 2012 crisis?

In Mali, the IMF had been advocating the implementation of a TSA since 2003. Before the coup, limited but encouraging progress had been made. A census of public bank accounts had been carried out, many dormant accounts closed, some important accounts opened at the BCEAO, and funds transferred to these accounts. Despite these reforms, half of government deposits were still kept in commercial bank accounts, a significant number of which remained dormant. With the reengagement of the Fund in late 2012, the implementation of the TSA became one of the immediate priorities of the government. Work on this project accelerated in September 2013, with the assignment of an FAD long-term advisor to the Malian Treasury, financed by the Belgium government. Following the advisor’s appointment, the authorities updated their survey of public sector bank accounts, stress tested the banking sector, and carried out a sequenced transfer of funds from commercial banks to the BCEAO-managed TSA.

By September 2014, all central government Treasurers were using the TSA; two-thirds of the accounts maintained in commercial banks had been closed and the outstanding balances transferred to the TSA; and most banking transactions were operated by the BCEAO.

What have been the key success factors?

- Strong political support for the reform -– the process was and still is explicitly and firmly supported by the authorities at the highest level, despite resistance from account holders, and to a lesser extent commercial banks. This support materialized through an official commitment to regulate the opening of public accounts, and the setting up of a reform committee reporting to the minister of finance.

- Revamping the legal framework -– the authorities transposed the WAEMU’s regional directives into Malian domestic law, including provisions for implementing the TSA.

- A steady but cautious approach -– there were three waves of transfers: first, central government accounts, followed by selected state-owned enterprises, and finally externally-funded project accounts. Exceptions were made for commercial banks which did not pass the stress tests, and some special items such as guarantee deposits complying with former government banking arrangements.

- An appropriate communication and training strategy -– targeted at a wide range of treasurers, paymasters and other PFM executives. Progress reports and lessons learned were systematically shared with all stakeholders.

- Clear signaling and outreach to the central bank and commercial banks -- through which the strategy was shared and discussed, and technical and operational constraints were analyzed and resolved (in particular, the capacity for the BCEAO IT system to accommodate government demands).

- Signing of formal agreements -- a first transitional banking agreement for cash management and specific reporting was followed by a service level agreement between the BCEAO and the Ministry of Finance. The latter provides for the turnaround times for the BCEAO to process banking transactions, the nature of information both parties are obliged to provide, and the timing of transfers from each commercial account to the TSA. Finally, an agreement between the commercial banks and the Ministry of Finance has been drafted to create zero-balance accounts (for receiving tax revenues and paying local wages or government suppliers, for example) and organize periodic transfers of balances within the TSA.

Looking ahead

Completing the implementation of a comprehensive and effective TSA will take additional effort and time if the full benefits of this reform are to be realized. The following steps are particularly important:

- First, to provide comprehensive and timely information -- for transparency and cash management purposes -- the Malian authorities need to finalize the creation of interfaces between government systems and the BCEAO’s IT system.

- Second, the BCEAO needs to accommodate its information systems and protocols to roll out TSAs in all other WAEMU countries.

- In addition, the BCEAO should consider expanding the range of services it offers to government agencies (for example, decentralization of its offices in the regions and the remuneration of surpluses held in bank accounts) to avoid the risk that these agencies revert to their former reliance on the commercial banking system.

1 Technical Assistance Advisors, PFM1 and PFM2 Divisions, Fiscal Affairs Department, IMF.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.