Posted by Benedict Clements and originally published on iMFdirect

We all hope to retire one day. Our pensions hold the promise of that.

But when that promise is a public pension, it’s also a lot like debt the government has to pay at some point in the future.

Good fiscal policy means thinking about how policy decisions—especially ones that involve long-term promises, such as pensions—affect government finances both today and in the future.

Problems, problems

The first problem is that good fiscal policy hasn’t always ruled the day, to put it mildly. Today, pension reform is a priority for the advanced economies as current trends are unsustainable—see Commandment V—and for many emerging and low-income economies that need “to improve coverage of health and pension systems in a fiscally sound manner.”

The second problem is that traditional deficit and debt indicators focus on the health of public finances today, but fail to capture the future impact of pension promises. This means that pension reforms, which often strengthen the fiscal position down the road, might not necessarily improve—and sometimes worsen—traditional fiscal indicators today. The risk is that assessments of pension reforms based on traditional deficit and debt indicators could create incentives to delay or even reverse reforms.

A “pension-adjusted” budget balance

This underscores the need for a fiscal indicator that gives governments credit for pension reforms that improve long-term fiscal health, but also correctly points out when they are moving in the wrong direction.

In a recent Staff Discussion Note, we propose a new indicator—the “pension-adjusted” budget balance—that takes into account the long-term nature of pensions. It focuses on the fiscal sustainability of pensions and provides a level playing field for evaluating a country’s pension policies. The new indicator achieves this by recalculating the traditional budget balance to take into account the intertemporal pension balance (that is, future pension imbalances), rather than the current pension balance.

In other words, and simplifying a little, this means taking account of the difference between the current value of future pension contributions and the current value of all future benefits, from today to a certain date in the future, say 50 years. And not just the difference between pension contributions and benefits today.

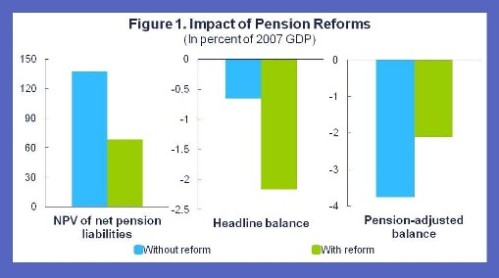

Figure 1 shows how pension reforms in selected countries can impact the total amount—or stock—of pension liabilities as measured today (that is, in terms of net present value, NPV), the traditional headline budget balances, and “pension-adjusted” balances. In looking at this chart, it is important to keep in mind that both the headline and pension-adjusted balances are annual flow concepts, while the NPV of pension liabilities is a stock concept (and thus much higher as a percent of a single year’s GDP).

- The reforms had a large impact on the NPV of net pension liabilities, even though headline balances are worse after the reforms because of the diversion of contributions to second pillar systems with mandatory private accounts.

- The pension-adjusted balance, on the other hand, improves with reforms that reduce the NPV of pension liabilities. This eliminates incentives to adopt or dismantle particular systems (including second pillar systems) to improve current-period fiscal indicators.

Policy design

This indicator can help measure when changes in pension policies are improving or worsening long-term fiscal health. One advantage is that it eliminates incentives to adopt or dismantle particular systems to improve current-period indicators. Of course, overall balances remain key for evaluating the risks surrounding short-term financing needs.

We draw three main implications for fiscal policy design:

- We should take account of the future impact of pension reforms, or other public programs such as health care, when we analyze fiscal sustainability.

- To do that, we should look at the sum of future pension balances, the intertemporal pension balance.

- The “pension-adjusted” budget balance should be viewed as a complement, rather than a substitute, for traditional fiscal indicators.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.