Posted by Yang-Hyun Jin, IMF Fiscal Affairs Department

In the mid-2000s, the Korean authorities launched a comprehensive fiscal reform package aimed at fostering fiscal sustainability through strengthening the public financial management (PFM) system. This package contained four fiscal reform pillars: (1) the national fiscal management plan (NFMP); (2) top-down budgeting; (3) performance-based budgeting; and (4) digital budgeting and accounting system. Korea’s medium-term expenditure framework (MTEF) is covered by the first two pillars.

The budget process was one of the key aspects of the PFM system that needed to be strengthened. Focused on a single budget year, the previous budget process relied heavily on a bottom-up approach. This approach made it difficult to cope with upcoming fiscal challenges, such as trend increases in spending on pension and health care resulting from a rapidly aging population. In addition, the previous process was also characterized by a relatively weak linkage between budgeting and policy making, as well as by limited autonomy of the line ministries. All these weaknesses negatively raised risks in terms of fiscal sustainability.

Since the MTEF has been implemented five years ago, the legal and institutional arrangements have evolved quite significantly. The national fiscal law was enacted in 2007 to back up the four pillars of reform. In addition, the Ministry of Strategy and Finance (MoSF), a new umbrella organization created by merging the ministry of planning and the ministry of finance in 2008, became responsible for the implementation of the MTEF.

I. The key characteristics of the Korean MTEF

A. Time horizon and government coverage

The national fiscal management plan (NFMP) covers a 5-year time horizon and is revised annually. The NFMP 2010-2014, for example, covers the then current year (2010), budget year (2011), and 3 out-years (2012-2014). The time horizon is a little longer than those of other advanced countries[1] which are implementing MTEF. The NFMP is a rolling plan, which is revised annually to update socio-economic environment changes.

The NFMP covers the entire central government. This means that all the resources under the discretion of the central government are reviewed and prioritized for spending. It includes the general account, the special accounts (18), and public funds (62) of the central government.

B. Macro fiscal forecasting and aggregate ceilings

Macro fiscal forecasting is carried out by the MoSF in close cooperation with the other stakeholders. The working group for macro economic forecasting, which consists of experts from the macro fiscal unit, the central bank, think tanks, and academia, plays a pivotal role in providing macro economic forecasts. Following in depth discussions about the prospects of global economic trends and domestic economic growth, the working group provides forecasts on gross revenue, aggregate expenditures, and fiscal targets.

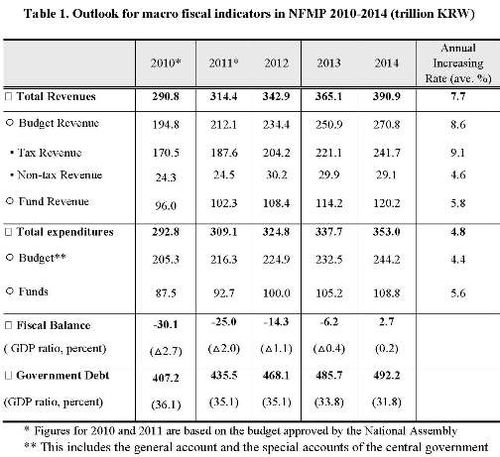

The medium-term fiscal policy puts an emphasis on strengthening fiscal soundness. The NFMP 2010-2014 emphasizes efforts to strengthen fiscal soundness in the medium and long term, reflecting reduced fiscal space stemming from the implementation of fiscal stimulus plans in the context of the global economic crisis. With the aim of achieving fiscal balance by 2013-2014, the NFMP stipulates a fiscal rule prescribing an annual growth rate of expenditure of 2-3 points lower than the revenue growth rate. As seen in Table 1 (below), the annual expenditure growth rate is projected to increase by 4.8 percent, while the revenue growth rate is expected to reach 7.7 percent.

Aggregate medium-term expenditure ceilings provide an anchor for fiscal policy and budget formulation, maintaining fiscal discipline. These ceilings evidence the authorities’ intention to achieve the publicly announced level of spending in the budget years as well as in the out-years. The ceilings can be broken down into the general account, the special accounts, and public funds. These ceilings can also be divided into 12 sectors of government functions and the existing ministries.

While the aggregate ceilings for the current and budget year are based on the budget approved by the National Assembly or submitted to it, the 3 out-year ceilings are more indicative. The ceilings are stated in nominal terms, which means that the level set for each year is neither adjusted for inflation, nor indexed in other ways. The aggregate ceiling for year t+2 becomes the starting point for the process of preparing the detailed budget for the subsequent year.

C. Setting medium-term ceilings for sectors

The NFMP sets medium-term ceilings for all 12 sectors. These sectors include R&D, industries and SMEs, infrastructure, agriculture, welfare and health, education, culture and tourism, defense, foreign affairs, public securities, and general administration. The resource allocation for social welfare and health has increased, while that for economic development is stable, reflecting structural socio-economic changes. These sectors cover the entire central government including ministries, government agencies, the judicial system, and other constitutional entities. For example, the sectoral ceiling for the welfare and health covers those of both the ministry of social welfare and the ministry of labor. The ministerial ceilings, which are not disclosed, are consistent with the sectoral ceilings. The final decision on the allocation of resources by sectors and ministries is made by the cabinet, in a meeting chaired by the President.

The policy direction and resource allocation plan for the 12 sectors appear in the NFMP. Each sectoral plan identifies its upcoming challenges, and presents major policy directions for the sector. A resource allocation plan for the major sub-sectors or programs is also presented in the NFMP. These sub-sectoral policy directions come from the policy discussions of the sectoral working groups. These groups consist of varied stakeholders including the line ministries, academia, and the private sector.

II. A top-down process anchored in a medium-term budgeting framework

In the context of the medium-term framework, the preparation of the government’s budget proposal can be divided into three distinct phases. The first phase is the determination of the total expenditure in the budget. The second phase is the allocation of the aggregate expenditure ceiling to sectoral or spending unit ceilings. The third phase is the detailed division of the spending unit ceiling into policies or programs and individual economic items such as wages and transfers.

The cabinet meeting, chaired by the president, discusses and agrees on the first and second phases of the budget process. The cabinet meeting, which takes place normally over two days in the spring, discusses the macro fiscal issues in-depth, and agrees on the aggregate expenditure ceiling and sectoral ceilings, based on a proposal from the MoSF.

The line ministries prepare their budget proposals so that they reflect policy priorities and respect the sectoral and ministerial ceilings. Through this, line ministries have more autonomy and discretion in allocating resources for programs and projects within the ceilings. The MoSF facilitates line ministries’ budget preparation by providing guidelines, including criteria for common expenses.

In the context of the Korean MTEF, the emphasis of top-down budgeting lies in enhancing the autonomy and accountability of the line ministries in budget formulation and management. In reviewing budget requests by line ministries, the central budget office previously focused on microscopic spending control of individual projects, which were more than 6,000.[2] The sectoral allocation and the total size of the budget were determined at the last stage of budget preparation by aggregating the expenditures on the individual programs. With top-down budgeting, the autonomy and accountability of the line ministries are expected to improve.

III. Assessment

Overall, the Korean MTEF has fostered consensus building and promoted fiscal sustainability both through strategic and the procedural aspects. In its strategic aspect, the MTEF has helped build consensus on the national policy directions and priorities by establishing multi-year total expenditure ceilings and fiscal targets clearly linked to high-level policy objectives. Sectoral and ministerial ceilings are also accompanied by a top-down budgeting process. In its procedural aspects, the MTEF contains two stages of consensus building deliberations, with in-depth discussions and debates among the stakeholders. The first stage appears in the working groups that draft the MTEF. The working group for aggregate economic indicators and the 12 sectoral working groups are included in these groups. Both groups consist of various stakeholders including the line ministries, academia, and private sectors. The second stage culminates in the cabinet meeting chaired by the President. Both stages receive wide media coverage, which serves as a forum for information sharing and consensus building for hot fiscal issues.

On the down side, the MTEF ceilings have frequently changed in the revision process, which could usefully be more binding. The current MTEF is a rolling plan that is revised annually. The aggregate ceilings, as well as sectoral ceilings on the MTEF, are often subject to noticeable changes during the annual revision process. Furthermore, the Parliament reviews and still approves the budget on an annual basis, without reference to the MTEF. This weakens the linkages between the annual budget and the MTEF ceilings that are submitted to the Parliament according to the fiscal law.

[1] With the introduction of program classification in mid 2000s, the number of the programs was reduced to about 1,000.

[2] Time horizon for Australia, Sweden, UK, and France is 3 years, while that of Finland, Netherlands is 4 years.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.