Posted by Juan-Ramon Ruiz

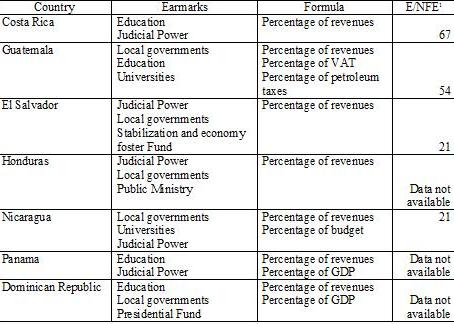

Earmarking is a very common PFM practice in Latin American countries. In Central America it has caused extensive problems for the management of public resources. Earmarking is the practice of assigning revenue, generally through statute or constitutional clauses, from specific taxes or general revenue, to specific government activities or areas. Earmarks are often defined as fixed percentages of general revenues or GDP. In Central America earmarks are used to finance areas like education, road maintenance and sports, but also to assign resources to autonomous entities, such as the judiciary, universities and local governments. The base used to determine earmarks in these countries is usually linked to internal revenues, or the amount collected from certain taxes, as the Value Added Tax, taxes derived from petroleum, sin taxes (on alcohol and tobacco), or gaming taxes. The table below presents an overview of important earmarks in a number of Central American countries, including the share of the budget which is determined by earmarks.

The objectives of the earmarks in Central American countries are to give more assurance to minimum levels of financing for public services that the political establishment considers worthy, or to assure the financial autonomy of some institutions. These earmarks have been established through constitutional clauses, and/or organic or tax laws, which makes their modification or elimination quite difficult. Earmarks represent in some cases an important percentage of the expenses of the annual budget, introducing rigidities in the assignment of the public resources. The IMF’s Code on Fiscal Transparency identifies earmarking of expenditures as a budgetary practice that leads to a decrease of expenditure flexibility and control, and a weaker prioritization and allocation process. Earmarks can negatively affect the efficiency and effectiveness of public expenditures, and undermine an appropriate implementation of a Medium-Term Expenditure Framework aimed at reducing fiscal deficits. The IMF generally supports efforts in countries to roll back the influence of earmarks, although this is often not easy given their legal status.

Not all earmarks are created equal however, and some, although by no means all, may even be beneficial. Earmarking works best when it is an extension of the benefit principle of taxation, used in the context of local government, where the correspondence of beneficiaries and taxpayers is closer and when beneficiaries/taxpayers can more easily express their preferences by voting. It can also be suitable to assure and to guarantee the financing of certain high-priority expenditures. Although, assigning of high priority status should be done conservatively and of course not be left to interest groups or benefiting government entities. There are international examples of successful earmarking in the areas of social security, and special sectors such as water and sewerage. Earmarking in other areas, such as highways, housing and training, has been notably less successful.

Most economists remain skeptical about earmarking, because it is difficult to achieve pricing and taxation arrangements that will allocate resources appropriately for the service in question. Often earmarking is not desirable even for programs in which redistribution or social welfare is emphasized, because the connections between revenue and appropriate levels of activity are tenuous. There are examples of such tenuous linkages in the education and health programs in Central America which are part of the National Plans for poverty reduction. Earmarking also does not work well in the case of pure public goods, since taxpayers are not able to reveal their preferences through voluntary individual payments.

The most common disadvantages of earmarking are indicated below:

- Misallocation of resources: either excess or less-than required financing of earmarked activities.

- Creation of a well-funded part of government and an underfunded part of government.

- Absence of budgetary evaluation: given that they cannot be changed and were determined long time ago, they are taken for granted and therefore the programs that they finance are usually not evaluated, or rarely assessed.

- Restriction to the legislative and executive powers for establishing public policies: the expenses are out of National Assembly’s and government’s control and decision making (particularly when they are constitutionally mandated).

- Budget inflexibility: earmarking systems continue after their usefulness has been served.

Any proposed scheme of earmarking carries its own set of potential problems even as it shelters one type of government expenditure from competition for funding from others. It would be appropriate to evaluate in any case the following aspects of any proposed earmarking:

- Is the benefit of taxation principle applied? In other words, if it exists or not, a relationship among the beneficiaries and those that finance them.

- Is the earmark necessary to improve the quality of services or the collection of revenue?

- Is the formula used for earmarking appropriate for the services demanded by the citizens, does it have important distortionary effects, deadweight losses, inflationary effects or any negative effects on the assignment of resources?

- Does the accounting and auditing procedures for these funds have safeguards against their misuse?

- Is there consistency with the government's macroeconomic policies and the allocation of resources?

- Is there capacity in the agency to which earmarked funds are assigned for planning, evaluating and carrying out the additional program activities?

- Is the investment program appropriate, with a clear set of rules to regulate investment decisions: spending on capital, maintenance and administrative overhead?

- Is there any cutoff date for deciding if the reasons that existed for financing and establishing the earmark are still in place and determining if the earmarking arrangements should be continued?

Central American countries in general should strive to reduce their existing earmarks. It is recommended that the Ministries of Finances of the region take a leadership role in the evaluation of them in order to eliminate them or improve their design.

1. Ratio of Earmarks to Non-financial central government expenditures as %.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.