Posted by Andrea Schaechter

Fiscal institutions and governance play an important role in prudent fiscal policy making. In the context of the EU’s fiscal framework—the Stability and Growth Pact—this was explicitly acknowledged with the Pact’s reform in 2005 when the European Council asked EU countries to strengthen their domestic fiscal governance, particularly by enhancing national fiscal rules and institutions. Most recently, recommendations for improved fiscal governance have played a role in the EU’s excessive deficit procedures, i.e. recommendations for those countries that have violated the 3 percent deficit threshold.

The European Commission has in December 2009 launched a Domestic Fiscal Governance Database (http://ec.europa.eu/economy_finance/db_indicators/fiscal_governance/index_en.htm) with detailed information on national fiscal governance frameworks in its 27 member states. It comprises three areas:

• National fiscal rules

• Independent fiscal agencies

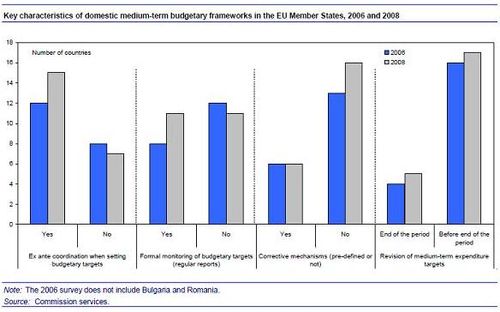

• Medium-term budgetary frameworks

The website includes databases on each of the three topics with quantitative and qualitative information (e.g., a description of the responsibilities of the independent fiscal agencies) and codified information on the governance frameworks’ characteristics. This feature facilitates the use of the database for analytical purposes. Moreover indices have been constructed by the Commission, on the strength and coverage of fiscal rules and medium-term budgetary frameworks (MTBFs). The time period covered on fiscal rules is 1990-2008 and on MTBFs the years 2006 and 2008.

The website also includes a number of useful overview charts (e.g., on key characteristics of medium-term frameworks (see below), the fiscal rules index, etc.) as well as references to work done by the EU and others on these topic. The country information is based on questionnaires to member states.