Posted by Mario Pessoa

The National Audit Department (NAD) created a ranking system to measure effectiveness of administrative controls. NAD is the Malaysian Supreme Audit Institution responsible for evaluating management performance of all ministries, departments, and autonomous entities at the central, states and local governments in Malaysia. To respond to concerns of the government on the repeated cases of non-compliance and weak internal controls mentioned in the annual audit reports, NAD developed a detailed rating system to measure control performance according to eight major criteria: (i) organizational management control; (ii) budgetary control; (iii) receipts control; (iv) expenditure control; (v) bank accounts control; (vi) asset and inventory management; (vii) investment and loan management; and (viii) financial statements. The methodology used is based on a four-star rating classification of a set of indicators and sub-indicators to indicate if performance is considered excellent, good, satisfactory, and not satisfactory. The Accountability Index is a very objective way to measure and compare control effectiveness across the entire government. The information since 2007 is available at NAD webpage www.audit.gov.my under the label “Accountability Index”.

The Methodology

For each criterion there is a set of indicators and sub-indicators used to capture the most relevant control issues. The assessment of the Organizational Management Control aims to ascertain to what extent the agencies have established an effective structure, system and procedure on financial management. The main indicators and sub-indicators to measure this criterion are: (i) organization structure: organization chart; delegation of power; segregation of duties; existence of structures such as Board of Directors, Top Management, and Councils; (ii) system and procedures: financial and accounting regulations; work procedure manual; desk file; surprise/spot checks; (iii) committee and Internal Audit Unit: financial management and accounts committee, audit committee; development action committee; management integrity committee; internal audit unit; (iv) human resource management: establishment; work transition plan; human development panel; training; surcharge.

On Budgetary Control the aim is to assess whether budgetary controls ensure that the agency budget is properly planned, prepared, and executed according to the legislation and entities’ objectives. Budget preparation; allocation distribution; approval of virement/supplementary allocation; monitoring of expenditure/performance; and reporting are evaluated.

On the Control of Receipts the objective is to ascertain whether the receipts are effectively managed according to the laws and regulations, and safekeeping, accuracy and completeness of accounting records are ensured. There are five indicators for this area: (i) control of revenue forms: usage of revenue forms and recoding of revenue forms; (ii) receipt of monies: authority/approval; security controls; receipts through mails; and receipts at the counter; (iii) bank-in collections; (iv) accounting control on receipts/revenues; and (v) management of account receivables.

On Expenditure Controls the aim is to determine whether all expenditures have been approved and utilized according to entities’ objectives. It includes: (i) accounting control; (ii) procurement management: direct purchase; general controls of quotation/tender; management of quotation; management of tender; records and contract agreements; and e-procurement; (iii) payment management: internal control on payment process; expenditure requiring special approval; payment registers/records; bill register; and management of petty cash imprest.

Regarding cash management there are three indicators to evaluate the management of the consolidated fund, revolving funds, and deposit accounts.

On asset and inventory management the focus is on the agencies’ capacity to properly manage, safeguard, and report on assets according to specific laws and regulations. There are seven indicators in this area: (i) general controls: asset committee; asset management unit; and asset officer; (ii) collection (delivery and acceptance controls): receiving officer and collection regulations; (iii) registration: registration administration; custody of register; and asset labeling; (iv) usage, custody, and inspection: usage; custody; asset inspection/stock verification; and usage of department’s vehicles; (v) asset maintenance: maintenance regulations and maintenance of vehicles; (vi) disposal: inspection board and disposal procedures; and (vii) loss and write-off: management of loss and management of write-off.

On Investment and Loan Management the objective is to assess whether investment and loans are properly managed. For investment management, the indicators cover the investment committee and the management of investment. For loan management, the indicators relate to the authority to obtain a loan, authority to give a loan, loan records, and loan agreement.

Finally, on the Financial Statement the purpose is to measure whether the financial position of the agency is adequately demonstrated in the accounting reports. The two indicators used are related to financial performance and submission of financial statements in terms of completeness and timeliness.

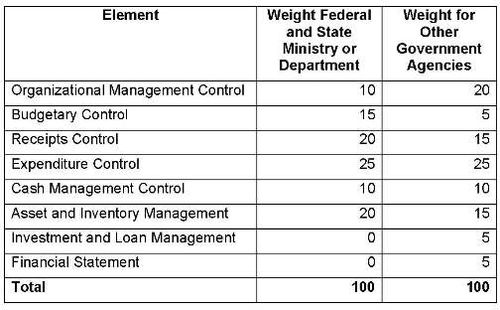

The score is calculated by attributing a 1 to 4 point score for each indicator or sub-indicator. Then weighted system considers the differences on risk and complexity. The weight list varies also if the agency is a federal or a state agency or is another other agency of the government. The weight list used is the following:

This comprehensive approach provides a tangible and comparable mechanism to inform authorities on the areas in which controls are more effective. Because NAD uses a standardized scoring system it gives managers a transparent tool to assess performance on control mechanisms. Results so far have indicated that federal ministries for example scores between 60 and 90. This means that there is good compliance on basic control requirements. However, as Malaysia is implementing more sophisticated reforms such as performance budgeting, the next step would be to include other variables related to the achievement of program objectives, cost-effective use of budget resources, and effectiveness of government policies. It would be also interesting to have an evaluation of the impact of such an approach after five years to assess whether controls have improved across the entire administration and why some agencies have performed better than others.

The Accountability Index guideline is available on the NAD webpage.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.