Posted by Rohini Ray[1]

A recent study by Ruiz Nunez and Wei[2] shows that emerging markets face an investment gap of 6.1 percent of GDP and need to double their current investment expenditure to meet the growing demand for economic infrastructure. Unlike in advanced economies, where the private sector is typically taking on a larger role in providing infrastructure, in emerging markets the public sector still finances most of these investments. Whilst there is a growing need for investments, debt defaults and rescheduling have been on the rise in emerging markets and, according to a study by Reinhart and Rogoff[3], almost tripled in Latin America and Asia between the period of 1950-74 and 1957-2006. Since a default lowers a country’s ability to borrow, it creates a vicious circle in which the investment gap and borrowing needs increase still further.

Against this background, it is interesting to consider how investments in a country’s capital stock and its public debt performance are related. Theoretically, greater investments and capital accumulation provide a saving mechanism for the governments of emerging markets. Building up a stock of assets provides these countries with a buffer against borrowing from development partners or on the international market, as capital can be liquidated to finance the resulting liabilities. Also, the economic returns to investment in infrastructure should yield productivity gains and higher growth, which in turn reduce the likelihood of default.It follows that increasing a country’s public capital stock should guard against the potential of a default episode. Conversely, a lower capital stock should increase the probability of default. Moreover, should a default episode occur, the resulting contraction of investment is likely to be greater than when a downturn in the economy is driven by a fall in consumption, because of the pro-cyclical nature of infrastructure investment.

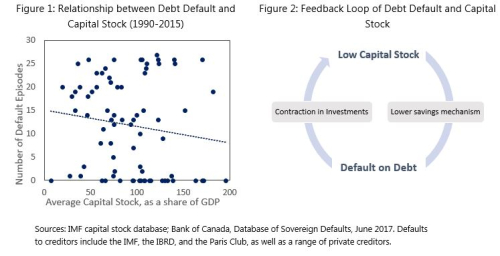

Another recent study[4] suggests that a higher capital stock increases a country’s ability to meet its debt obligations, and thus reduces the probability of default. Figure 1 below shows the relationship between debt default and the capital stock of 91 emerging markets over the period 1990-2015. The chart suggests that, on average, having a lower capital stock is positively correlated with the occurrence of debt defaults.

If the borrowing incurred is channeled into public-sector wages, or private consumption, then the probability of default becomes higher as the country’s liabilities increase while its capacity to repay the debt does not. And, in the case of a default episode, investments in capital are affected the most, due to their procyclical nature. This results in a decline in the capital stock as a ratio of GDP, thus increasing the infrastructure gap, and creating a negative feedback loop, as illustrated in Figure 2.

How can emerging markets turn this vicious circle into a virtuous circle? Many of these countries only have access to short-term debt, which is cheaper[5], but doesn’t encourage capital investments. The key question, therefore, is what mechanisms can emerging markets develop to open up their markets for longer-term borrowing, or must the financing of their capital infrastructure projects continue to rely on international organizations?

[1] Research Assistant, Public Financial Management I Division, Fiscal Affairs Department, IMF.

[2] Ruiz Nunez, F., and Z. Wei. 2015. Infrastructure Investment Demands in Emerging Markets and Developing Economies. World Bank Policy Research Working Paper, WPS 7414.

[3] Reinhart, C., and K. Rogoff. 2008. This Time is Different: A Panoramic View of Eight Centuries of Financial Crises. NBER Working Paper 13882.

[4] Gordon, G., and P. Guerron-Quintana. 2013. Dynamics of Investment, Debt and Default. Federal Reserve Bank of Philadelphia Working Paper.

[5] Broner, F., G. Lorenzoni, and S. Schmukler. 2013. “Why Do Emerging Economies Borrow Short Term?”. Journal of the European Economic Association, Vol. 11, Issue 1.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.