Carlos Pimenta [1] and Maria Veronica Cetrola Raven [2]

For most countries in Latin America and the Caribbean (LAC) increasing growth and improving social equity are key objectives. To achieve these goals, it is essential to have, not only good governance and good public policies, but also efficient public management. The publication Government at a Glance Latin America and the Caribbean 2017 (available in both English and Spanish) is the product of a joint effort between the Inter-American Development Bank (IDB) and the Organization for Economic Co-operation and Development (OECD). It provides internationally comparable data on government activities and their results in the OECD and 15 LAC countries (Argentina, Brazil, Haiti, Chile, Colombia, Costa Rica, Ecuador, El Salvador, Jamaica, Mexico, Panama, Paraguay, Peru, the Dominican Republic and Uruguay). This dashboard of key indicators aims to help LAC governments and citizens better understand and benchmark their country’s practices and performance against regional peers and OECD Countries.

The study includes 45 key indicators covering key aspects of public management such as: the redistributive impact of fiscal policy, public finance and economics, public employment, regulatory governance, open and digital government, cost-benefit analysis of public investment projects, budgeting for health care and public procurement. This second edition includes a special chapter on the impact of fiscal policy on equity. Governments can influence equity, not only through spending, transfers, and taxes, but also by designing and implementing policies that promote economic growth and job creation, tack inequalities in income distribution, and providing equitable access to key services.

During the previous decade, supported by favorable external conditions, LAC combined economic growth with better income distribution, structural reforms, and improvements in public sector performance. However, faced with the current challenging global environment and lower demand for commodities, governments will need to improve the efficiency and effectiveness of public spending and to design and implement policies to better promote growth and social equality.

Below summarizes some of the key findings, stylized facts, and lessons of this publication which can help to guide public sector reforms in the region:

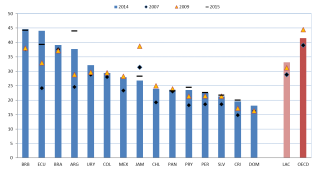

In the LAC region, the state is much smaller on average than in OECD countries. In LAC, public spending is on average 31% of GDP compared to 41.5% in OECD countries, however, this difference is diminishing (see figure 1). Public spending in the OECD amounts to about US$ 17,000 per capita, and in LAC it is less than US$ 6,000 per capita. Given this gap in public spending, LAC governments face a major challenge in ensuring that their policies have greater impact with fewer resources.

Figure 1: General government expenditures as a percentage of GDP, 2007, 2009, 2014 and 2015

(click image above to enhance)

Despite recent progress, LAC remains the most unequal region in the world with a regional Gini coefficient of 0.49 after taxes and transfers, compared to 0.29 in OECD countries. Fiscal policy, which can be a powerful tool to reduce inequality, currently plays a more limited role in income distribution in LAC countries than among OECD countries. Tax-benefit systems tend to less redistributive in the LAC region than in OECD countries.

Public investment as a percentage of GDP reached 2.6% in LAC countries in 2014 compared to an average of 3.2% in the OECD. This is not enough to achieve high rates of economic development and build the infrastructure needed to increased growth. In addition, governments in LAC could contribute to the region's economic productivity by reducing barriers to trade and investment, which are much higher than in the OECD.

Regarding the quality of public services, most LAC countries currently have a national citizenship portal as a single point of access to state services. However, to access all the benefits of these portals, different governments could adopt new, more transactional technologies. Governments are making efforts in the LAC region to make information openly available to the public. However, they could do more to facilitate their use by citizens and engage with them in designing solutions that meet their expectations and needs.

Although there are important lessons to be learned from OECD countries, there are some key aspects of e-procurement where LAC countries outperform OECD countries. For instance, 65% of LAC countries that have an e-procurement portal have a functionality that supports the electronic submission of bids, whereas in OECD countries this number is 28%. In LAC, 53% of countries carry out e-auctions compared to 31 percent in the OECD.

As for the quality of human resources in the public sector in LAC, the use of merit-based recruitment and competitive recruitment has improved in the region, while performance evaluation and compensation management still require further development. In many countries, performance evaluation tends to be formal in nature, with a limited effect on performance. Public employment as a percentage of total employment averages 12.4% in LAC countries, compared to 21.6% in OECD countries.

Several challenges lie ahead for LAC. One important pillar to ensure the region is well positioned to overcome these challenges is having a government that can design, execute and implement public policies that will promote growth, reduce inequality and enhance the quality of life of the region’s citizens.

It is important for LAC to foster a culture of public policy evaluation that can feed back into the process of designing and implementing policies. This is to help ensure policies and programs have the right incentives, target needed groups, and deliver quality services which achieve the desired impact. Additionally, the region could enhance its policymaking by promoting greater citizen engagement with the public sector. This could help improve and make more efficient the delivery of public services to the civil society.

Promoting reforms in the way governments operate is not an easy task. With this publication, we seek to help Latin America and the Caribbean to better understand its current situation and to map out future opportunities using concrete, quantitative and comparable data to improve the impact of its public policies on development.

For more information, please find the publication available in English and Spanish.

[1] Carlos Pimenta, Principal Specialist, Fiscal Management Division at the Inter-American Development Bank: Holds a master’s degree in public sector management. He has experience as public executive, consultant and project manager, and is staff at IDB since 2001. Previously, Carlos worked at the Federal Government in Brazil in different positions, as the Executive Secretary of the Council of State Reform, National Secretary in the Ministry of Administration and State Reform, President of the National School of Public Administration, and Vice Minister of Labor and Public Administration.

[2] Maria Veronica Cetrola, Consultant, Fiscal Management Division at the Inter-American Development Bank: Holds a bachelor’s degree in Business Administration and a specialization in Finance from American University. She is also a master’s degree candidate in Applied Economics at the Johns Hopkins University in Washington, DC. Veronica is an independent consultant to the Inter-American Development Bank (IDB), in collaboration with the Organisation for Economic Cooperation and Development (OECD), in the areas of public financial management and institutional capacity of the state.