Posted by Benoit Wiest and Pokar Khemani[1]

Why is integrity of fiscal data so important? Fiscal data relates to the use of public funds and its accurate reporting is a high priority for governments and donors, as well as for the IMF in its work on surveillance and program monitoring. Comprehensive fiscal reporting in line with international standards such as the IMF’s Fiscal Transparency Code and the Government Finance Statistics Manual (GFSM 2014) provides reasonable assurance about a government’s fiscal position and the integrity of the underlying data. However, the accuracy and reliability of government accounts and fiscal data can still be an issue. In many cases, the data provided by the authorities for program monitoring and surveillance are characterized by significant and persistent statistical discrepancies between the fiscal balance (“above-the-line”) and net financing (“below-the line”). These discrepancies are usually an indication of underlying weaknesses in a country’s public financial management (PFM) system, as well as issues with the integrity of financial data, and processes for collecting and disseminating this information. Significant and persistent discrepancies in data may require an investigation, and the development of specific measures to deal with these issues.

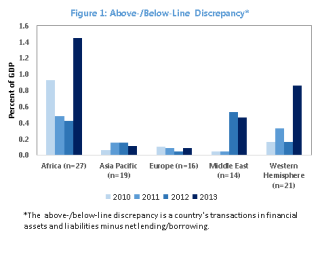

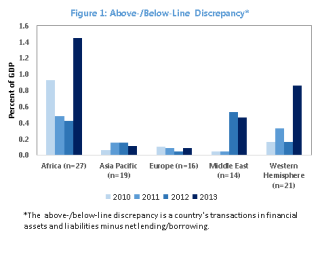

Discrepancies in fiscal and financing data are a common problem across a number of countries as illustrated below. Figures 1 and 2 show, for a sample of countries by region over the period 2010-13, the estimated statistical discrepancies between the fiscal balance and net financing, and stock–flow discrepancies (click images to enhance).

To address those concerns, a new “How To” Note published by the IMF’s Fiscal Affairs Department[2] provides guidance on how to detect issues of fiscal data quality, perform integrity checks, and reconcile data from various sources. Reconciliation of discrepancies in fiscal and financing data can point to weaknesses in PFM systems, but may also shed light on the potential misappropriation of funds, or illegal financial transactions. In many countries, despite the presence of financial management information systems (FMIS) with embedded controls, simple accounting reconciliations may highlight many types of irregularity, but these checks are often not routinely conducted. For example, the reconciliation of bank accounts – which is essential to ensure consistency with the government’s reported cash operations - is often delayed or incomplete.

The note discusses the following key issues relevant to the integrity of fiscal data:

- The main sources of discrepancies between fiscal and financing data. Discrepancies may be due to inconsistent institutional coverage: for example, if certain public entities are covered in the financing data but excluded from the central government’s fiscal accounts; or the circumvention of control and reporting mechanisms such as the use of suspense and advance accounts, off-budget accounts, or quasi-fiscal activities.

- How to conduct reconciliations by applying integrity checks to ensure the internal consistency, accuracy, and reliability of fiscal data. These checks include the reconciliation of bank accounts, stocks and flows of government debt, and financing data.

- How to assess and investigate the quality of fiscal data by identifying relevant sources of information such as trial balances, budget execution reports, and the general ledger of the FMIS, and then ensuring that the institutional coverage of these reports is consistent.

- How to perform a reconciliation of bank accounts. The note includes an appendix setting out the methodology for bank reconciliation, and a template for the use of the authorities and country teams.

The note also provides practical guidance for IMF country teams to ensure that fiscal and financing operations are accurate and reliable and, should there be inconsistencies in the data, how to explain the differences and take remedial action. While the responsibility to investigate and resolve discrepancies lies primarily with the authorities, country teams should ensure that these reconciliations are performed in a timely manner.

The note identifies areas where technical assistance from the Fiscal Affairs Department or the Statistics Department of the IMF can be helpful. Tools such as the Fund’s Fiscal Transparency Evaluation, or the Public Expenditure and Financial Accountability (PEFA) assessment framework can be useful in identifying weaknesses related to the PFM system. The Data Module of the IMF’s Reports on Observance of Standards and Codes can point to sources of statistical discrepancy, and provide guidance on how focused technical assistance can help the authorities build capacities and take any necessary remedial action.

Finally, the note provides two case studies of Malawi and Nicaragua. In these countries, discrepancies between fiscal and financing data were large and successfully resolved through technical assistance missions and remedial actions taken by the authorities.

[1] Benoit Wiest is an Economist with the Fiscal Affairs Department of the IMF, and Pokar Khemani is a Visiting Scholar to the IMF.

[2] IMF Fiscal Affairs Department, “How To” Notes, No. 4, November 2016, “How to Check Integrity of Fiscal Data”, by Pokar Khemani and Benoit Wiest.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.