Posted by Teresa Curristine and Mercedes Garcia-Escribano[1]

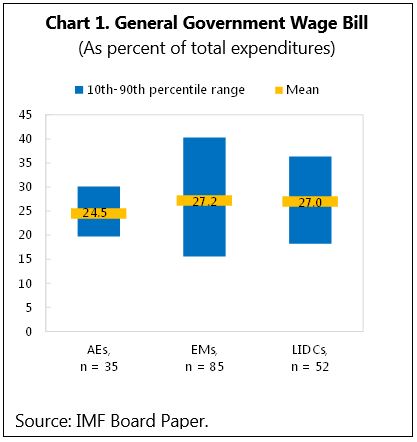

Government wage and employment policies have important social and economic implications. The government is the major employer in many countries, delivering key public services and typically spending around 25 percent of its budget on the wage bill (See Chart 1). Given its sizable budget weight, how the wage bill is managed heavily influences the sustainability of public finances, the quantity and quality of key public services, and as governments are major employers, private sector pay and employment.

Despite its importance, wage and employment policy is a relatively neglected area of study. A recent IMF paper Managing Government Compensation and Employment fills this gap. In particular, this paper:

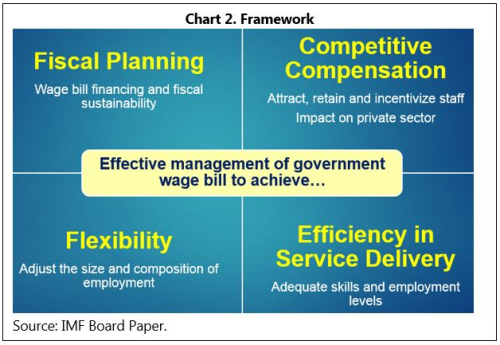

- Develops a new conceptual framework (See Chart 2) to help better understand and address the challenges governments face in managing their wage bill. According to this new framework, effectively managing the wage bill requires: adequate fiscal planning to ensure appropriate and sustainable financing of the wage bill; competitive compensation to attract and retain skilled staff; and employment flexibility to adjust staffing levels and composition in response to changing demographics and technology and to promote efficient delivery of quality public services.

- Uses this framework and draws on new datasets—on general government wages and employment and on institutions for wage bill management—together with 20 case studies to derive its key findings.

In practice, effective wage bill management has proven challenging for countries across all income groups.

Understanding the Challenges

Fiscal Planning: Even on an annual basis, governments find it challenging to adequately plan and finance their wage bill. Increases in the wage bill have on average been associated with a deterioration of short-term fiscal balances. In other words, wage increases are not adequately financed within the existing budget and are only partially compensated for with additional revenue. Governments find it particularly difficult to contain wage bill increases during economic upswings and prior to elections.

Over the medium term, pressures on wages are expected to increase, making adequate fiscal planning of the wage bill even more important. This is the case across all income groups and despite the existing cross-country variation in wage spending levels, which in turn reflects different national choices about the government’s role, levels of economic development, and resource constraints. In advanced economies, the wage bill has stabilized at an average of 10 percent of GDP, but pressures to increase spending related to aging populations are mounting as governments have to finance high debt levels. The wage bill has been rising in emerging market economies and in LIDCs, and has reached around 9½ and 7½ percent of GDP, respectively, and it will continue to increase as these countries seek to improve access to key services such as education and health.

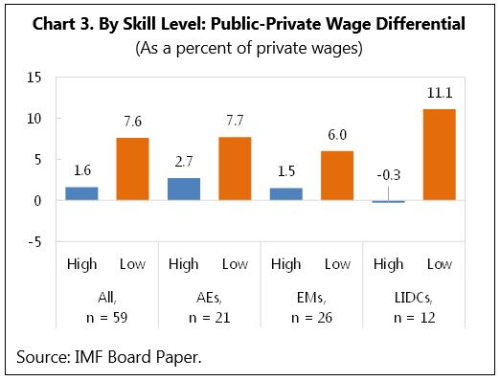

Competitive Compensation: Public sector wages are usually higher than private sector wages for comparably skilled workers. There are, however, significant variations by country income group, skill level and gender (See Chart 3). Public sector wage premiums are higher for low-skilled compared to high-skilled employees, resulting in greater wage compression relative to the private sector. The premium is typically larger for women than men, especially in low income countries, meaning that gender pay differences are less in the public sector than the private sector.

Flexibility and Efficiency: Countries’ inability to flexibly adjust employment levels and composition in response to demographic and technological change impacts the efficiency and quality of service delivery. For instance, in advanced economies, the number of teachers has not decreased in line with the decline in the school-aged population, resulting in excessive employment levels, without any commensurate improvement in education outcomes. Evidence also shows that during fiscal consolidation episodes, governments tend to focus on adjusting wages rather than sustainable changes in employment levels.

Tailoring the Solutions

- Regular comparison of public and private sector wages provides governments with information that enables them to compete with the private sector in attracting skilled staff and to inform wage negotiations.

- Position-based employment systems with more contractual employment facilitate greater flexibility in workforce deployment than career-based systems, where life tenure is the focus.

- Implementing a unified wage scale, which incorporates allowances, to help ensure wage levels are equitable and transparent.

- Restructuring the public sector, for example, via mergers of functions and units, to promote more efficient employment levels.

As part of their efforts to strengthen wage bill management, governments need to improve the collection of data on compensation and employment levels and to better monitor these numbers. This data can help in determining the sources of wage bill pressures (i.e., whether it reflects employment or compensation levels, or pressures in specific sectors) and in designing reforms aimed at enhancing wage bill management and service delivery.

Our next steps include making public the unique new data sets—that we compiled when preparing this paper—and producing additional research papers using this data. The IMF will continue to provide training and technical assistance on improving public wage bill management. An example of capacity building is the regional seminar AFRITAC South held in collaboration with IMF Fiscal Affairs Department in June 2016.

[1] Teresa Curristine is a Senior Economist in the Public Financial Management II Division of the IMF Fiscal Affairs Department and Mercedes Garcia-Escribano is Deputy Division Chief, in the Expenditure Policy Division of the IMF Fiscal Affairs Department.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.