Posted by Delphine Moretti

As discussed previously on this blog, the IPSASB Governance Review Group (“the Review Group”) conducted an online global public consultation, from January 17 to April 30, 2014, to garner views from the public at large on the future directions for the governance and oversight of the International Public Sector Accounting Standards Board (IPSASB). The summary of answers to the consultation has now been published.

Responses to the Consultation

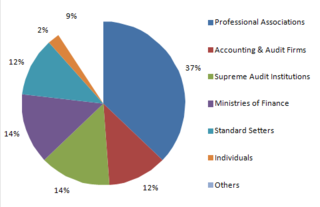

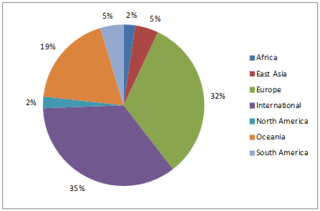

The public consultation was open to contributions from all interested parties. A total of 43 responses were received from a variety of institutions and regions as shown in the figures below.

Respondants by Type

Respondants by Region

These results, both in terms of number of answers received and variety of respondents, underscored the widespread interest in improving the governance and oversight of the IPSASB. In particular, the public sector, ministries of finance and supreme audit institutions, and standard setters accounted for almost half of the answers. Major international organizations responsible for setting and promoting standards for governments have been involved also in the consultation either as members of the Review Group (IMF, World Bank, and OECD), or as respondents (Eurostat, and United Nations).

Themes from the Consultation Responses

Strengthening the governance of the standard setting process for public sector accounting has been under discussion for a number of years, and respondents welcome the efforts of the Review Group for improving the oversight of the IPSASB. The responses provided valuable inputs into the development of solutions.

A comprehensive review of responses to the consultation’s five questions was discussed by the Review Group in September and published recently [ Download IPSASB RG Consultation Summary revised FINAL (2)].

The main themes that emerged from the consultation responses were:

1. Pragmatic consensus about the near-term, but more divergent views about the long term

The bulk of responses advised to keep the IPSASB under the auspices of the IFAC. This was considered to be the most feasible option in the near term. Respondents noted in particular that such an arrangement would leverage the existing funding arrangements, and minimize disruption to the functioning of public sector accounting standard-setting activities. A significant number of respondents also thought that this should be considered as a step towards more ambitious reforms.

However, views differed on the optimal accounting standards setting arrangements for the public sector over the longer-term. Some felt that standard setting functions should ultimately be carried out and overseen by a single body for both the public and private sectors. Others stressed the need for greater differentiation in the standards and standard-setting arrangements for public and private sector.

2. A “light touch” approach to oversight

Many respondents advised setting-up relatively “light” governance arrangements – meaning a single body in charge of the monitoring and oversight of the IPSASB, with a limited numbers of members. Again, this was considered as the most practical solution, mainly to limit the administrative and financial costs.

3. A central role for international organizations

Many responses underlined that international organizations should play a key role in the future monitoring and oversight body. The mission of these organizations would be to strengthen, where necessary, the current governance arrangements, and to ensure appropriate consultation and transparency in the development of the IPSASB work program and standards.

4. The need for a Consultative Advisory Group

Respondents also noted that technical issues with the standards may have impeded their adoption over the last years. To address this problem, many of them advised to set up a Consultative Advisory Group (CAG). They underlined that this would enable the IPSASB to receive direct feedback from interested public and private sector institutions, especially those engaged in the preparation, audit, or evaluation of public sector financial statements, on their strategy, work program, and standard-setting activities.

The next steps

Based on the consultation responses and its discussions in Paris in September, the Review Group will be publishing its recommendations for strengthening the governance and oversight of the IPSASB by the end of 2014.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.