Posted by Andy Wynne, andywynne@lineone.net

Timely, clear and open annual financial statements play an essential role in the accountability of governments to parliament and their citizens. However, there are no widely adopted international standards that reflect existing good practice. Virtually all developing countries currently use the modified cash basis. But there is no internationally accepted guidance that details the standards and good practices which should be adopted for this approach.

The only available international standard is the Cash Basis International Public Sector Accounting Standard (IPSAS). This was first issued in January 2003, but although it has been widely promoted by the donor community, PEFA and IFAC, not a single government in the world has actually been able to adopt this standard. This is not from want of trying, many governments have looked at the standard, but recognised that it is not practical to implement its key requirements. It is estimated, for example, that at least 31 governments in Africa have tried to adopt this standard. One international consultant recently estimated that he had worked in around 30 countries trying to adopt the standard, but that its key requirements had not proved practical.

The two main reasons for the failure to adopt the Cash Basis IPSAS are:

- the core requirement for full consolidation of all controlled entities

- the requirement to disclose support received in kind from donors.

This was recently confirmed by three experienced international consultants at the recent ICGFM conference and in a presentation in 2010, Nino Tchelishvili, Deputy Head of the Treasury Service, Georgia said that:

Fully implementing the Cash Basis IPSAS at national government level is not feasible for any country: Infeasible to consolidate accrual GBEs; Data requirements on transactions with donors.

Full consolidation of all controlled entities would require the consolidation—and elimination of all transactions between—central government ministries, departments and agencies, but also all government business enterprises (state owned companies or parastatal organisations) and probably local governments. No government in the world actually achieves this due to the complex nature and multiple entities which would be involved. The UK Government is said to have produced the most comprehensive consolidation with its Whole of Government Accounts which were issued last year. Despite consolidating approximately 1,500 bodies at a cost of around £1.5 million, this exercise omitted a further 1,800 bodies including the nationalised banks, rail infrastructure and public universities (see an earlier PFM blog post).

The key challenge for developing countries wanting to adopt the Cash Basis IPSAS would be the consolidation of Government Business Enterprises (GBEs or nationalised industries). This is because at least some of these produce accounts on the accrual basis and so these would have to be converted back to the cash basis before consolidation. This explains why South Africa, for example, produces separate “Consolidated Financial Information” for its public entities (GBEs). These statements are not consolidated with information from its national departments (ministries). Similarly Uganda produces consolidated financial statements for its central ministries, departments and agencies, but its GBEs are excluded as the benefits are not considered to be worth the effort. The Government Accounting Standards Board of India goes further (2008) saying:

Though this is fundamental requirement of Cash IPSAS, it is likely to cause more distortion than bringing in clarity in the financial statements of government… Further, consolidating Government Companies accounts with that of Government will result in artificial inflation of cash inflows and outflows and is not likely result in any improved presentation of financial statements (page 9).

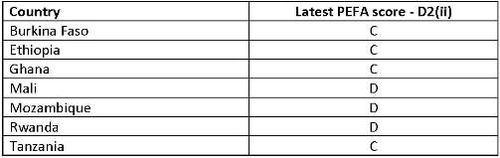

The other major challenge with implementing the Cash Basis IPSAS is the requirement for governments to disclose aid received in kind from donors, for example, where donors fund a project directly rather than through the government’s financial systems. The challenge here is that governments are dependent on donors supplying the relevant information and few donors actually do this. PEFA performance indicator D2 (ii) requires donors to provide information for at least 50% of the projects they fund to score ‘C’. The most recent scores for the following countries show that even this is not always achieved:

In contrast, although the Cash Basis IPSAS only requires that aid received from “significant classes of providers of assistance should be disclosed separately”, in a recent survey of practices in sub-Saharan Africa, aid received from individual donors was often found to be reported, as is the case for example, with Burkina Faso, Ghana, Mauritius, Rwanda and Tanzania.

The IPSAS Board has recognised that there are significant problems with their Cash Basis IPSAS and in November 2008 a Task Force as established to review the standard with the primary objective to “indentify any major difficulties that public sector entities in developing countries have encountered in implementing the Cash Basis IPSAS and determine whether it should be modified in the light of these difficulties”.

The Task Force reported to the IPSAS Board meeting in June 2010 and made a number of recommendations including:

- the requirements for consolidation reflected in the Cash Basis IPSAS should be revisited

- the IPSASB should join with other international and national organisations to develop guidance on what may be encompassed under the modified cash and the modified accrual bases of financial reporting.

However, due to lack of resources, these recommendations are not being implemented and no further progress has been made on revising the Cash Basis IPSAS.

What is needed is for existing good practices to be identified and used as a basis for ensuring that the Cash Basis IPSAS becomes a practical standard that most governments can implement within the medium term. A start has been made with a study, funded by the African Capacity Building Foundation. This reviewed the annual financial statements of 12 governments from across sub-Saharan Africa and identified attributes of good practice.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.