Posted by Patrick Shyaka, Caleb Rwamuganza, and Michael Schaeffer[1]

International good practice dictates that government controlled trust funds and extra-budgetary funds should be brought within the Treasury Single Account (TSA). Although all Rwandan donor project accounts reside within the National Bank of Rwanda, none of these project accounts have been integrated with the government's primary Treasury Single Account. From a cash management perspective, shifting donor project funds from their current accounts in the Central Bank into the Treasury Single Account (TSA) will be of immense benefit to the government.

The Government of Rwanda launched its pilot (development partner) project TSA in December 2011. The pilot project TSA currently covers 14 key project bank accounts with balances of approximately US$75 million. During 2012, the Government of Rwanda intends to expand the Project TSA accounts to include more project accounts.

The consolidation of cash resources through a Project TSA arrangement is meant to optimize government cash management. Effective aggregate control of cash is a primary fixture in monetary and budget management. The primary objective(s) of Rwanda’s Project TSA include: efficient budget execution and management; minimizing transactions costs, and engaging in effective reconciliation between banking and accounting data.The following discussion provides a brief overview of how the government of Rwanda was able to extend its Treasury Single Account to include Development Partner Project accounts.

Background

At present, most development partner project funds are still maintained in separate accounts in the Central Bank which are not a part of the main TSA. The National Bank of Rwanda (BNR) manages in total 652 project bank accounts. These project bank accounts comprise multiple currencies, including: Euro, British Pound Japanese Yen, US dollar, and Rwandan Franc (RWF) project accounts. The balances on these accounts vary monthly depending on the projects’ disbursement requirements. As of March 2012, BNR estimates have put the total value of all project accounts at US$215 Million.

Development Partner Support

Recognizing that a number of improvements in budget transparency have taken place in Rwanda over the past 10 years with respect to the quality of Rwanda’s public financial management systems, donor agencies are generally supportive of bringing project funds into the main TSA. The preference of all development partners in Rwanda is to increasingly adopt country systems to improve aid effectiveness. The Treasury Department at Ministry of Finance and Economic Planning (MINECOFIN) worked through a number of development partner concerns including: (i) non-diversion of funds, (ii) exchange rate issues, (iii) transactions costs associated with sweeping project accounts (if any), (iv) changes in development partner bank statements, (v) reliability of government financial controls, and (vi) various legal assurances. As a result of the confidence that donor partners have in the financial management process of the Government of Rwanda, the government was encouraged during the 2010 Development Partners Meeting by the donor community to go forward with the establishment of a project treasury single account.

Government of Rwanda’s TSA Structure

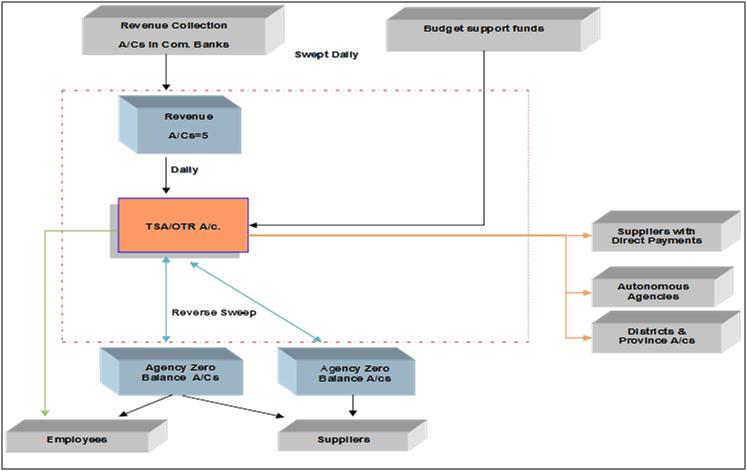

The Government of Rwanda’s main TSA is currently structured as a single integrated RWF account. Requests for payments are prepared by individual budget agencies and sent to a central treasury payment unit for control and execution. The central payment unit manages the float of outstanding invoices. This system creates a synergy between cash management and expenditure control and transaction accounting. Budget agency accounts are subaccounts of the TSA and are swept daily.

Figure 1: Government of Rwanda's Current TSA Structure

Source: MINECOFIN (2011); AFE (IMF) (2011).

Although the payment and accounting functions are largely centralized, individual spending agencies are treated as distinct accounting entities through a treasury ledger system. Information on individual ledger accounts of the various spending agencies (including information on their respective transactions) is maintained and controlled by the treasury. Through the main TSA, the Treasury deals with the commercial banks, making payments from the TSA and receiving collected revenues into the TSA. The Treasury processes and records all inflows and outflows and cash balances in the appropriate ledger account.

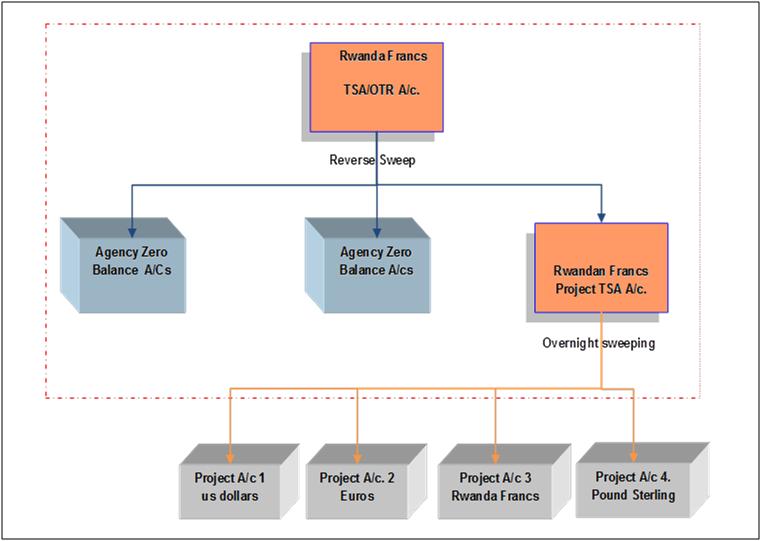

How is the Rwandan Project Treasury Single Account designed to work?

The Government of Rwanda's Development Partner Project TSA has been organized along the following broad working principles:

- Project accounts at the BNR are zero-balance accounts (ZBAs)[2];

- Balances of the project accounts are automatically swept at the end of each day to the TSA main account via the transit project TSA a/c;

- BNR consolidates the balances in all the accounts at the end of each day. These funds are recorded at the TSA and returned in the morning at the same exchange rate to the project accounts[3].MINECOFIN has access to real-time data on the account balances and transactions, which greatly facilitates accounting and reporting

The sweeping/reverse sweeping of project accounts has had no impact on the daily management of project accounts. Project managers are still able to:

- Produce checks from these accounts (as per current practices), and,

- Produce financial reports as required by the Public Financial Management Law (law on state finance and property)[4].

- Project accounts are still subject to audit as per standard practice required by the Audit Law.

The Project TSA converts development partner project funds into RWFs on transfer to the TSA. MINECOFIN recognizes that some development partners may be reluctant to this approach. However, to overcome this, MINECOFIN agreed through a memorandum of understanding with the National Bank of Rwanda that for daily sweeps and reverse sweeps that one exchange rate would be used. Thus, effectively eliminating any foreign currency risk associated with overnight sweeping arrangements.

The Project TSA will allow better aid alignment as committed in the Paris Declaration (Paris High Level Forum, 2005). Channelling donor project resources through the TSA will enhance aid effectiveness while also achieving the target of the Paris declaration to the use of country systems (indicator 5a of the Paris declaration).

Figure 2: Sweep Project Accounts into Project TSA in RWF

Source: MINECOFIN (2011); AFE (IMF) (2011).

The project TSA is still in its infancy, however establishing a unified structure of bank accounts, including project accounts, is expected to generally improve cash management and control, and should facilitate better reconciliation of fiscal and banking data, which in turn improves the quality of fiscal information.

[1] The authors are respectively Accountant General of the Ministry of Finance and Economic Planning of Rwanda, Deputy Accountant General of the same ministry, and, IMF PFM Advisor - East AFRITAC, based in Dar es Salaam.

[2] ZBAs are transactional accounts for which at the end of each day, cash balances are swept back into the TSA main account. Such accounts are used for disbursements or for the collection of financial resources. At the end of the day all financial resources in the account are swept back (deposited) into the TSA. The bank would honor payments of the project, and would be reimbursed by the TSA overnight.

[3] Two factors assist in fully restoring the funds: 1) there is little or no volatility evidenced in the RWF versus other currency movements; and, 2) the National Bank of Rwanda has agreed to sweep back all funds using the same exchange rate that they were swept in the previous evening. MINECOFIN and National Bank of Rwanda have signed a memorandum of understanding to this effect.

[4] The Government’s SMARTFMIS is being used for national government transactions. There is currently a migration to SMARTFMIS in procurement and project management. Although projects do not currently use SMARTFMIS for the day-to-day transactions, they are projected to begin using SMARTFMIS as part of the Government’s routine payment structure in the near-to-medium term.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.