Posted by Greg Horman

As economies recover, fitfully, from the global economic and financial crisis, policymakers are facing the challenge of how to accelerate growth. Growth alone will not be enough, however, to restore public finances to a sustainable path. Fiscal consolidation is necessary as well, but the challenges here are even more difficult.

Recent work by the IMF, including the Fiscal Monitor Update in June 2011, finds that the pace of adjustment in advanced countries is uneven. Consolidation is well underway in some places, but has been only modest so far in others. Some countries have yet to begin to address long-run imbalances. Indeed, continual fiscal deficits have characterized public finances in many advanced countries over the past decades. Deficits rose during downturns, but were not reduced sufficiently during years of economic expansion to prevent debt levels from climbing. More than ever, governments are being scrutinized by citizens, markets, and their sovereign peers over their commitment to bring down deficits and debt.

A new report by the Organization for Economic Cooperation and Development offers further evidence of the challenges ahead in its 34 member countries. In 2011, gross government debt is expected to exceed 100 percent of GDP in the OECD area. By the end of 2010, only around half of OECD countries had announced medium-term fiscal consolidation programs. While many adjustment plans call for spending cuts and revenue enhancements in 2011, fewer contain detailed information required for the following years. The cross-country analysis in the report is complemented by country notes that present the current fiscal position and announced fiscal strategies, consolidation plans, and detailed expenditure and revenue measures (quantified where possible) for 30 OECD member countries. It also discusses institutional changes to budget systems that member countries are considering, such as enhanced fiscal procedures and rules, as well as fiscal councils that would evaluate the extent to which countries are on the right track.

A useful contribution by the report is a taxonomy of countries in terms of the size of the needed fiscal consolidation and whether they have already announced detailed medium-term plans. As is well known already, the European Union “PIGS” (Portugal, Ireland, Greece, and Spain), plus Hungary, have faced intense concern from financial markets about bringing public finances under control and have announced plans for substantial adjustment. Their plans, like those announced in most other countries, place greater weight on reducing expenditure than on enhancing revenue, although action on both sides is called for.

The arguably “virtuous” countries are those that have been pre-emptive in acknowledging fiscal imbalances and have announced sizeable consolidation plans. They include Estonia, Germany, the Netherlands, New Zealand, the Slovak Republic, and the United Kingdom. The plans for these countries lay out detailed quantified measures, although further quantification is warranted in the case of New Zealand and the United Kingdom, according to the OECD.

The third group of countries comprises those that have yet to announce well-articulated consolidation plans. This group includes economies of global and regional importance, such as the United States, Japan, France, and Poland.

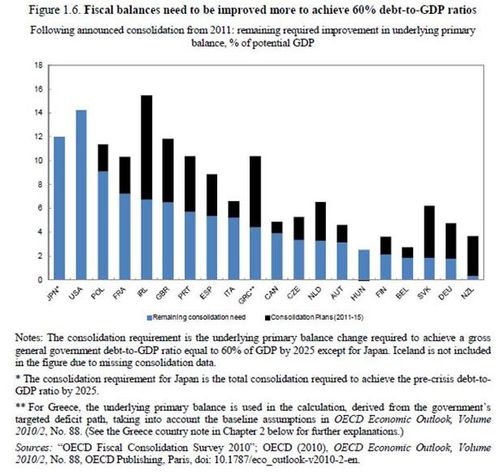

The following graph shows the consolidation effort of OECD countries necessary to reach public debt levels of 60 percent of GDP by 2025. It illustrates how this goal, which is especially important for countries that are part of the euro area, requires significant strengthening in primary balances. The graph indicates the extent to which governments have already made medium-term decisions to bring about the required change in primary balances (shown in black). More necessary adjustment (shown in blue) lies ahead.

Prospects are not gloomy for everyone, however. A fourth group, containing Australia, Chile, Finland, Korea, Norway, Sweden, and Switzerland, are all in the enviable position of having comparatively low consolidation demands.

A challenge for all governments, even for those that have already embarked on consolidation, is to stay the course beyond the near term. That calls for creating public understanding and support for restoring fiscal sustainability. As the report notes, this is no easy task for policymakers, but it is not impossible. And, ultimately, it cannot be avoided.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.